Bitcoin After the GHash.IO Era

Visualizations made in ChartLab, author has no position in Bitcoin.

Introduction

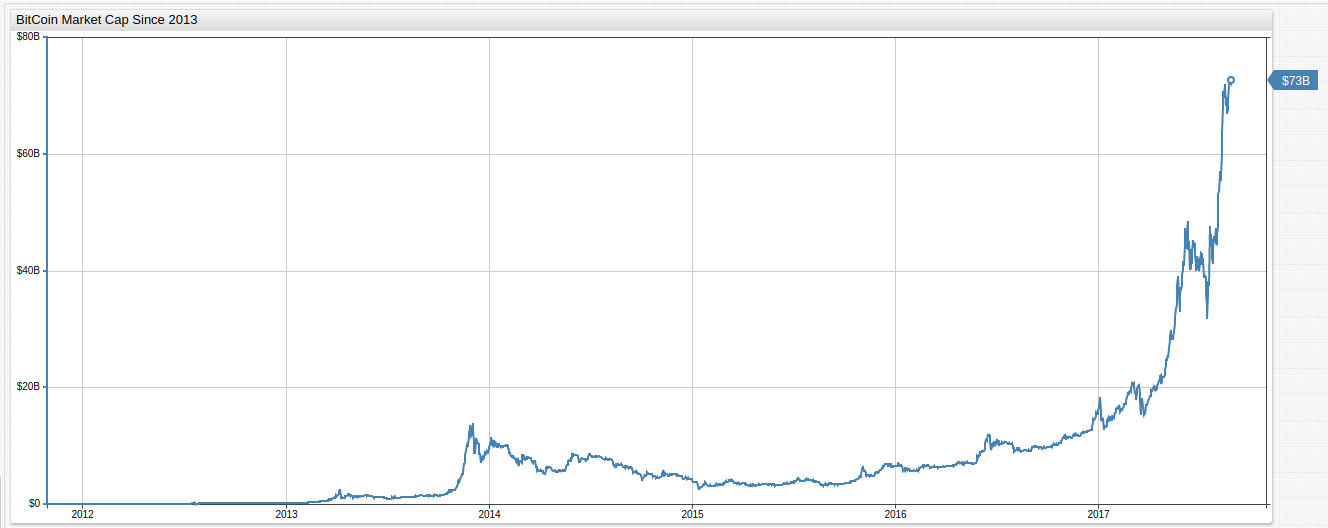

Since its introduction by the enigmatic figure known only as Satoshi Nakamoto, Bitcoin has transformed from a fringe investment security used by speculators and dark web consumers to the premier cryptocurrency with a market capitalization of more than $70 billion USD and an average of more than 200,000 transactions a day since 2016. Bitcoin is created through a process called mining, special machines are built specifically for the task, and they quickly appeared after the debut of Bitcoin. Collective mining operations called pools followed shortly after as well, advantageous because the large-scale nature of certain operations gave rise to better results.

Figure 1: Bitcoin Market Capitalization

Source: CoinDesk

Open the ChartLab visualization above and navigate through time using the drop-down lists at the top of the screen.

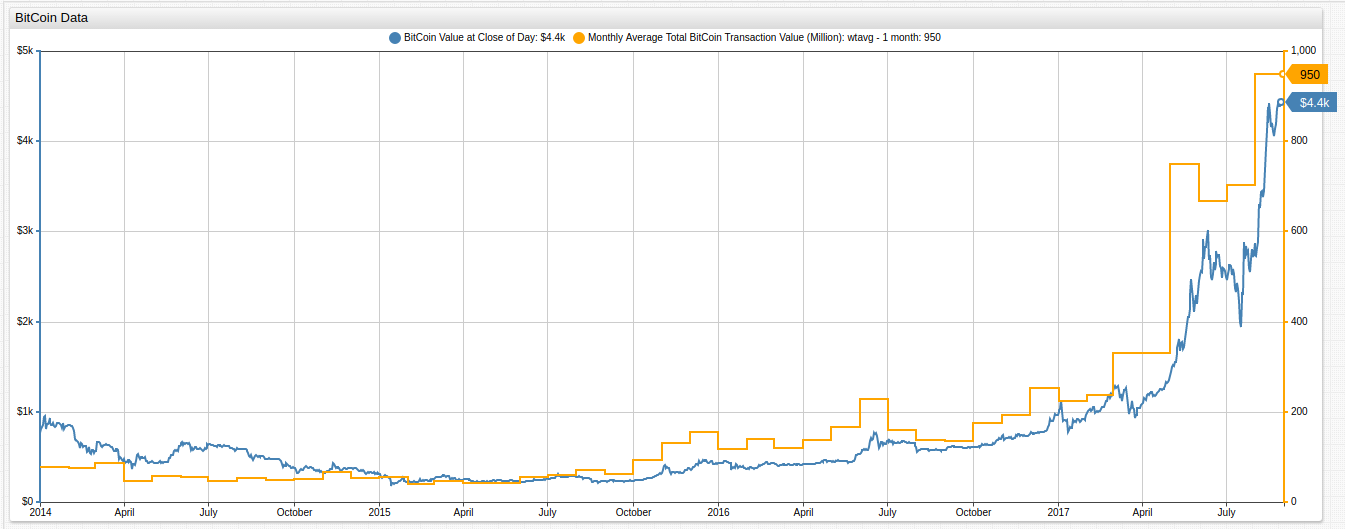

In July 2014, a Bitcoin mining pool known as GHash.IO breached an unspoken Bitcoin convention by achieving 51% of the total hash power for the first time in the short history of Bitcoin, which established what became the first Bitcoin trust. In the months leading to GHash.IO gaining control of the 51% majority of the total hash rate the Bitcoin market was rattled and owners began to dump what they had, causing the value of Bitcoin to plummet at the beginning of the year when speculation began to occur about when GHash.IO would reach the dreaded 51% mark. Though the number of transactions remained consistent, the value of those transactions also decreased as shown below.

Figure 2: Bitcoin Value and BTC Transaction Value (2013-2015)

Source: Quandl - Market Capitalization, Estimated Transaction Value

Open the ChartLab visualization above and navigate through time using the drop-down lists at the top of the screen.

For those unfamiliar with Bitcoin mining technique and terminology, the currency operates using a blockchain protocol, that is, all bitcoins are inseparably linked through a combination of numbers designating all previous bitcoin transactions. Miners gain new bitcoins by confirming these transactions with their personal machines, verifying the combination of numbers is valid, and then attempting to discover the next link in the blockchain through brute force, literally guessing. The hash protocol is designed to make the most efficient way to discover a new hash is brute force or random input. If a more efficient method is discovered somehow, that particular hash protocol is discarded and no longer used. Special hardware units have been made to complete this guessing process for users, all they have to do is supervise and wait.

Hash rate is the measure at which a machine is able to compute the hash function per second, effectively completing one guess. Because of the nature of the protocol, the higher the hash rate, the more bitcoins a particular machine is able to mine. Hash rate is directly proportional to the profitability of the miner.

Not long after the establishment of Bitcoin, mining pools formed to more effectively extract new coins, with profits split among participants. One of the more successful outfits called GHash.IO soon established a dominant position on the Bitcoin market and within a year of its establishment approached 51% control of the Bitcoin hash rate, potentially giving them unprecedented power over the market.

Outcome

Eventually, GHash.IO disbanded, the operators of the mining group understood the implications of a 51% hash rate shareholder: they could effectively counterfeit bitcoins through double spending of coins, a problem created by a loophole in the blockchain protocol methodology (whereby the user is effectively able to verify their own transaction and the transaction fee, only to spend the original coin again because they now hold consecutive blocks unknown to anyone else), deny pending transactions from other bitcoin miners because of their control of consecutive points in a given blockchain, and exercise the powers of a central monetary authority, something that those who established Bitcoin sought to avoid with its distributed levers of power.

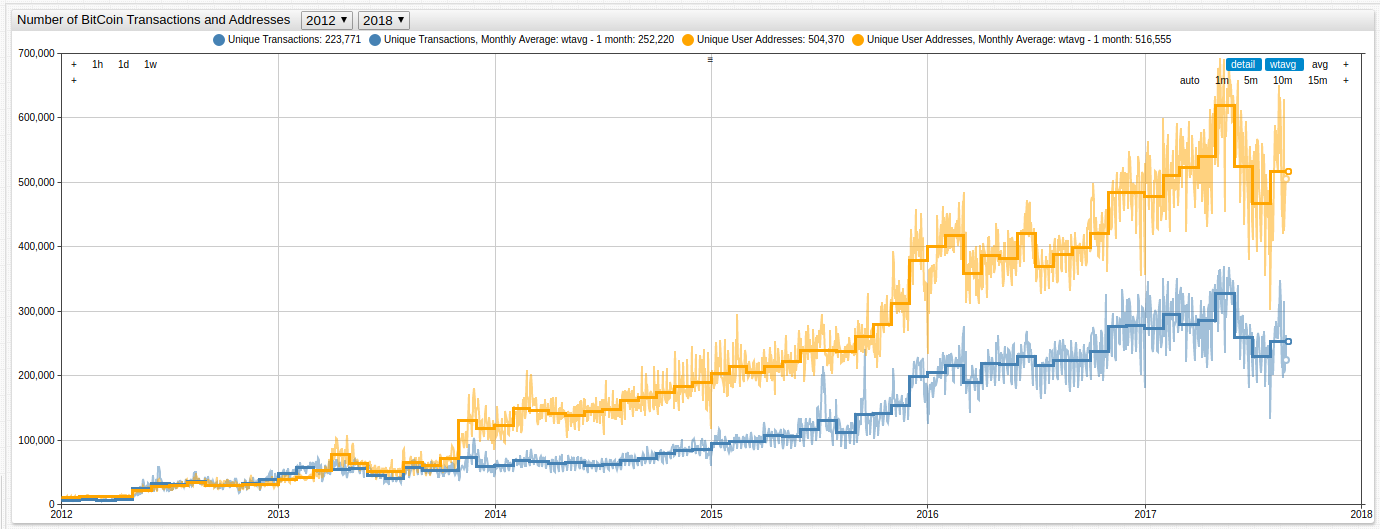

However, since the mining pool disbanded and new guidelines were established for miners and mining pools, Bitcoin has generally seen a healthy resurgence in both usage and value.

Figure 3: Bitcoin Value and BTC Transaction Value (Post 2014)

Source: Quandl - Market Capitalization, Estimated Transaction Value

Open the ChartLab visualization above and navigate through time using the drop-down lists at the top of the screen.

The Future of Cryptocurrency

The number of transactions occurring each day using Bitcoin has reached impressive levels since its emergence in 2009 and despite a contraction in recent months, the figure remains strong with over 200,000 unique transactions occurring each day. Additionally, the number of unique Bitcoin addresses has also continued to increase, showing that even today new users are opening Bitcoin wallets and beginning to invest themselves.

Figure 4: Bitcoin Usage Metrics

Source: Quandl - Number of Users, Number of Transactions

Of course, Bitcoin is utterly dwarfed in size when compared to other payment processors; Mastercard, for example, handles around 300 million unique transactions a day, but its relevance is growing all the time. Russian Deputy Minister of Finance Alexei Moiseyev recently announced that qualified investors can possibly trade Bitcoin on the Moscow Stock Exchange, and unnamed U.S. elected officials are currently striving to extend the same kind of legal protection to Bitcoin that exists for other currency, with respect to seizure of assets.

These concerns began to surface in 2013 after agents from the Federal Bureau of Investigation arrested collaborators involved in the organization and operation of Silk Road, an Amazon-like website hosted on the internet that allowed users to buy and sell whatever they wanted anonymously. Naturally, illegal transactions began to occur with increasing frequency ultimately resulting in the lifetime imprisonment of Silk Road founder along with several members of the law enforcement team who investigated him. After the dust settled, the FBI became the single largest holder of Bitcoin in a wallet.

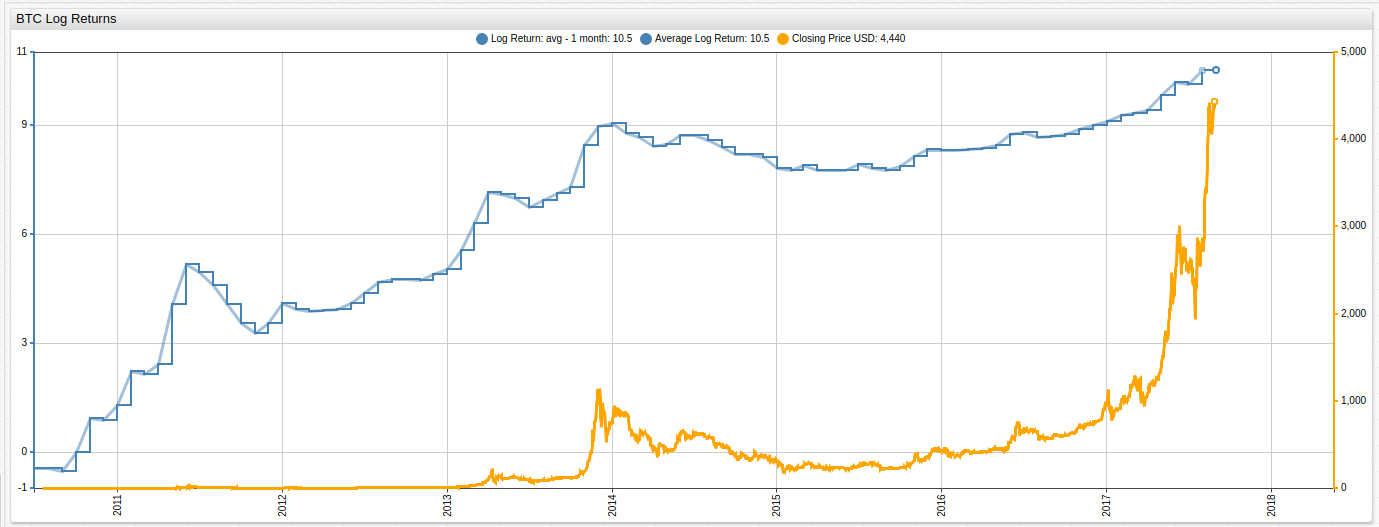

Additionally, one of the hallmarks of the early years of Bitcoin was volatility, huge surges and plunges in value as the currency sought some kind of root in the real world. Using econometric analysis in the ChartLab interface, the traded value of Bitcoin is normalized using log returns to track how the currency has stabilized.

Figure 5: Bitcoin Closing Value Log Returns

Logarithmic, or log, returns are a simple methodology used by traders to normalize the value of a given stock. The same principle can be applied here to the traded value of Bitcoin because its volatility more closely resembles that of a stock, than that of a currency in normal circulation. Log returns here demonstrate that the volatility present in the early days of Bitcoin are not as common in its current incarnation. Fluctuations in price of several hundred percent occurring in a matter of a few days occurred often in the early years of Bitcoin, though they appear quite insignificant when seen alongside the jumps in value that Bitcoin has showed of late, in fact they happened much less predictably that current Bitcoin fluctuations.

Conclusion

The near future has something in store for Bitcoin and Bitcoin users, hundreds of new cryptocurrencies have appeared on the modern market, some of them more successfully then others, to challenge the supremacy of Bitcoin in the digital currency world. But Bitcoin has made moves to stay relevant as well, recently splitting the blockchain into unique entities, Bitcoin Classic and Bitcoin Cash for those interested in using Bitcoin as an investment security or a day-to-day payment processor respectively. Other Bitcoin forks exist as well, each serving some niche of the Bitcoin community. Whatever your feelings on Bitcoin are, the once tiny digital currency has made its home in the public eye and is becoming more and more difficult to denounce as a fringe movement.