Tax Rates by State: Corporate, Individual, Sales (2017)

Visualization and analysis tools from Axibase

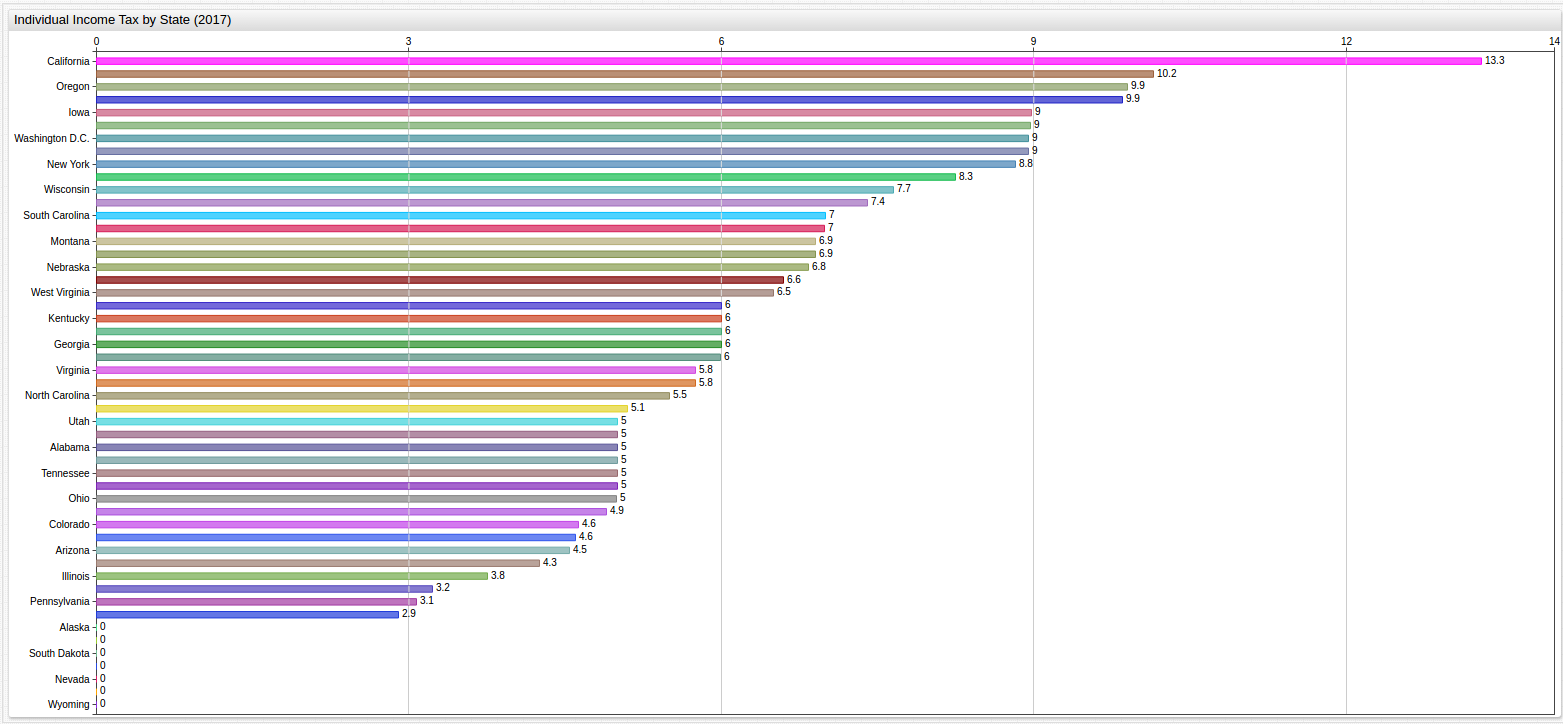

State Level Individual Income Tax Rate

SELECT tags.state AS "State", value AS "Individual Income Tax Rate (%)"

FROM state_individual_income_taxrate

GROUP BY 'State', value

ORDER BY value desc

| State | Individual Income Tax Rate (%) |

|---|---|

| California | 13.30 |

| Maine | 10.15 |

| Oregon | 9.90 |

| Minnesota | 9.85 |

| Iowa | 8.98 |

| New Jersey | 8.97 |

| Vermont | 8.95 |

| Washington D.C. | 8.95 |

| New York | 8.82 |

| Hawaii | 8.25 |

| Wisconsin | 7.65 |

| Idaho | 7.40 |

| South Carolina | 7.00 |

| Connecticut | 6.99 |

| Montana | 6.90 |

| Arkansas | 6.90 |

| Nebraska | 6.84 |

| Delaware | 6.60 |

| West Virginia | 6.50 |

| Georgia | 6.00 |

| Louisiana | 6.00 |

| Kentucky | 6.00 |

| Missouri | 6.00 |

| Rhode Island | 5.99 |

| Maryland | 5.75 |

| Virginia | 5.75 |

| North Carolina | 5.50 |

| Massachusetts | 5.10 |

| Alabama | 5.00 |

| Tennessee | 5.00 |

| Oklahoma | 5.00 |

| New Hampshire | 5.00 |

| Mississippi | 5.00 |

| Utah | 5.00 |

| Ohio | 5.00 |

| New Mexico | 4.90 |

| Colorado | 4.63 |

| Kansas | 4.60 |

| Arizona | 4.54 |

| Michigan | 4.25 |

| Illinois | 3.75 |

| Indiana | 3.23 |

| Pennsylvania | 3.07 |

| North Dakota | 2.90 |

| Washington | 0.00 |

| Wyoming | 0.00 |

| Florida | 0.00 |

| South Dakota | 0.00 |

| Nevada | 0.00 |

| Texas | 0.00 |

| Alaska | 0.00 |

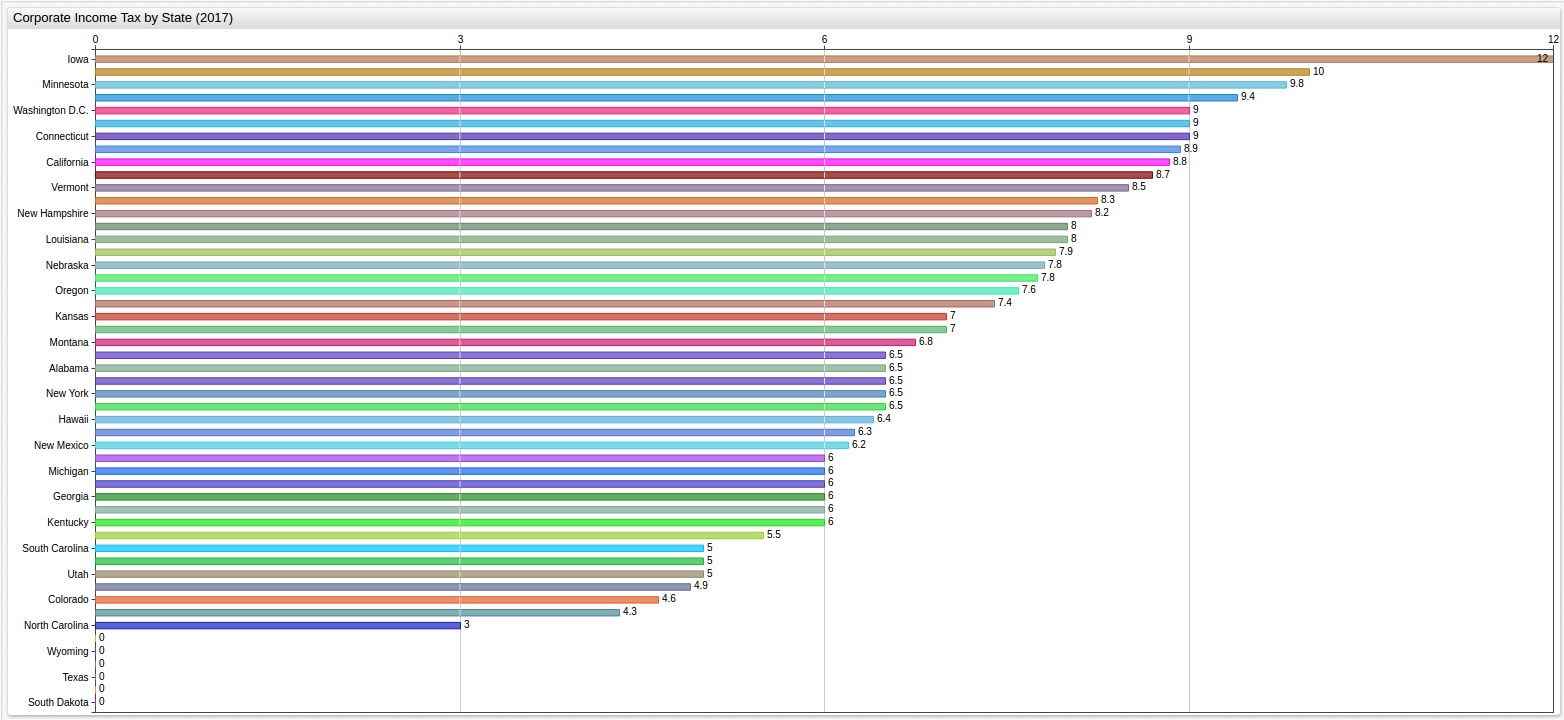

State Level Corporate Income Tax Rate

SELECT tags.state AS "State", value AS "Corporate Income Tax Rate (%)"

FROM state_corporate_income_taxrate

GROUP BY 'State', value

ORDER BY value desc

| State | Corporate Income Tax Rate (%) |

|---|---|

| Iowa | 12.00 |

| Pennsylvania | 9.99 |

| Minnesota | 9.80 |

| Alaska | 9.40 |

| Connecticut | 9.00 |

| New Jersey | 9.00 |

| Washington D.C. | 9.00 |

| Maine | 8.93 |

| California | 8.84 |

| Delaware | 8.70 |

| Vermont | 8.50 |

| Maryland | 8.25 |

| New Hampshire | 8.20 |

| Louisiana | 8.00 |

| Massachusetts | 8.00 |

| Wisconsin | 7.90 |

| Nebraska | 7.81 |

| Illinois | 7.75 |

| Oregon | 7.60 |

| Idaho | 7.40 |

| Kansas | 7.00 |

| Rhode Island | 7.00 |

| Montana | 6.75 |

| New York | 6.50 |

| Alabama | 6.50 |

| Tennessee | 6.50 |

| West Virginia | 6.50 |

| Arkansas | 6.50 |

| Hawaii | 6.40 |

| Missouri | 6.25 |

| New Mexico | 6.20 |

| Georgia | 6.00 |

| Indiana | 6.00 |

| Oklahoma | 6.00 |

| Kentucky | 6.00 |

| Michigan | 6.00 |

| Virginia | 6.00 |

| Florida | 5.50 |

| South Carolina | 5.00 |

| Mississippi | 5.00 |

| Utah | 5.00 |

| Arizona | 4.90 |

| Colorado | 4.63 |

| North Dakota | 4.31 |

| North Carolina | 3.00 |

| Washington | 0.00 |

| Wyoming | 0.00 |

| Ohio | 0.00 |

| South Dakota | 0.00 |

| Nevada | 0.00 |

| Texas | 0.00 |

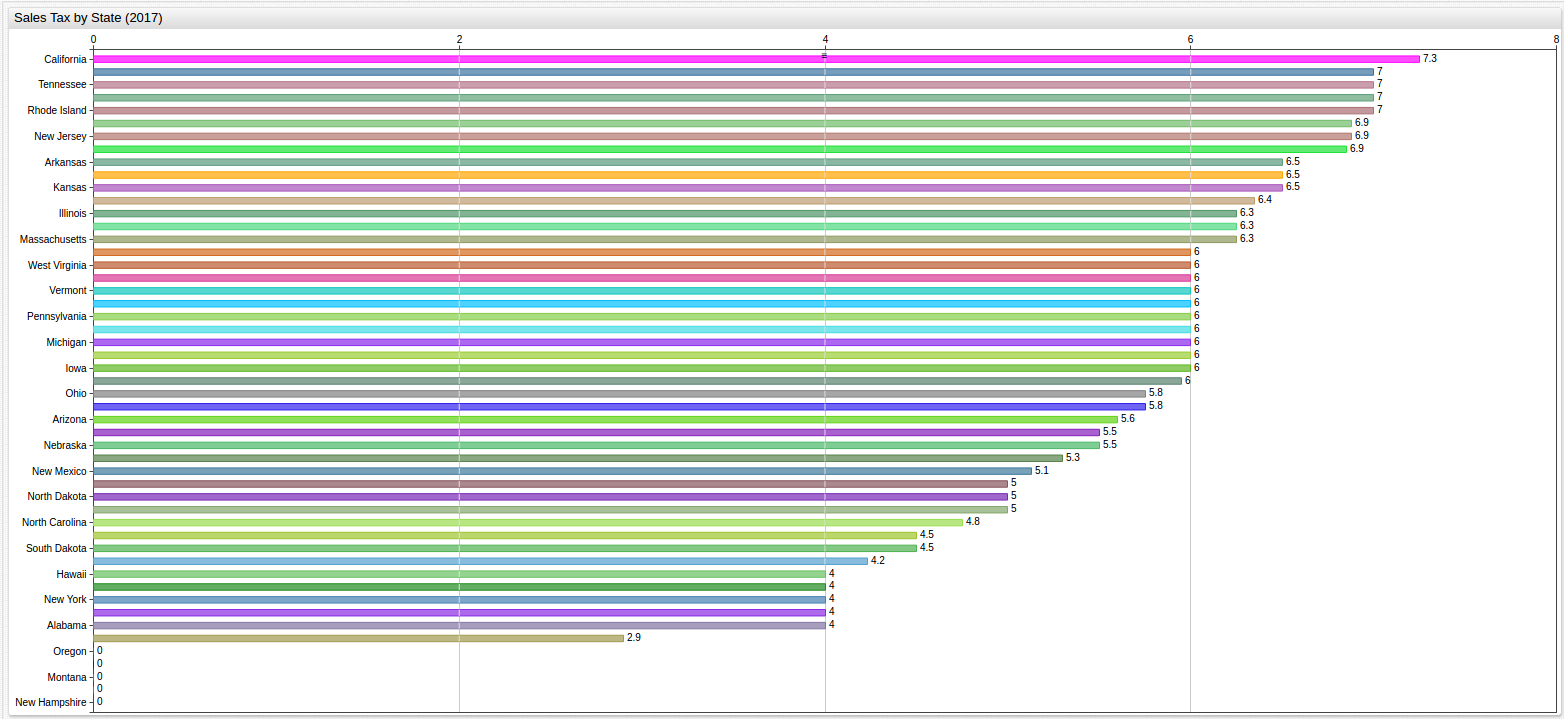

State Level Sales Tax Rate

SELECT tags.state AS "State", value AS "Sales Tax Rate (%)"

FROM state_sales_taxrate

GROUP BY 'State', value

ORDER BY value desc

| State | Sales Tax Rate (%) |

|---|---|

| California | 7.25 |

| Indiana | 7.00 |

| Tennessee | 7.00 |

| Mississippi | 7.00 |

| Rhode Island | 7.00 |

| New Jersey | 6.88 |

| Minnesota | 6.88 |

| Nevada | 6.85 |

| Washington | 6.50 |

| Arkansas | 6.50 |

| Kansas | 6.50 |

| Connecticut | 6.35 |

| Illinois | 6.25 |

| Massachusetts | 6.25 |

| Texas | 6.25 |

| Florida | 6.00 |

| Maryland | 6.00 |

| South Carolina | 6.00 |

| Iowa | 6.00 |

| Idaho | 6.00 |

| Kentucky | 6.00 |

| West Virginia | 6.00 |

| Michigan | 6.00 |

| Pennsylvania | 6.00 |

| Vermont | 6.00 |

| Utah | 5.95 |

| Ohio | 5.75 |

| Washington D.C. | 5.75 |

| Arizona | 5.60 |

| Nebraska | 5.50 |

| Maine | 5.50 |

| Virginia | 5.30 |

| New Mexico | 5.13 |

| Louisiana | 5.00 |

| North Dakota | 5.00 |

| Wisconsin | 5.00 |

| North Carolina | 4.75 |

| South Dakota | 4.50 |

| Oklahoma | 4.50 |

| Missouri | 4.23 |

| New York | 4.00 |

| Georgia | 4.00 |

| Wyoming | 4.00 |

| Alabama | 4.00 |

| Hawaii | 4.00 |

| Colorado | 2.90 |

| Delaware | 0.00 |

| Oregon | 0.00 |

| Montana | 0.00 |

| Alaska | 0.00 |

| New Hampshire | 0.00 |

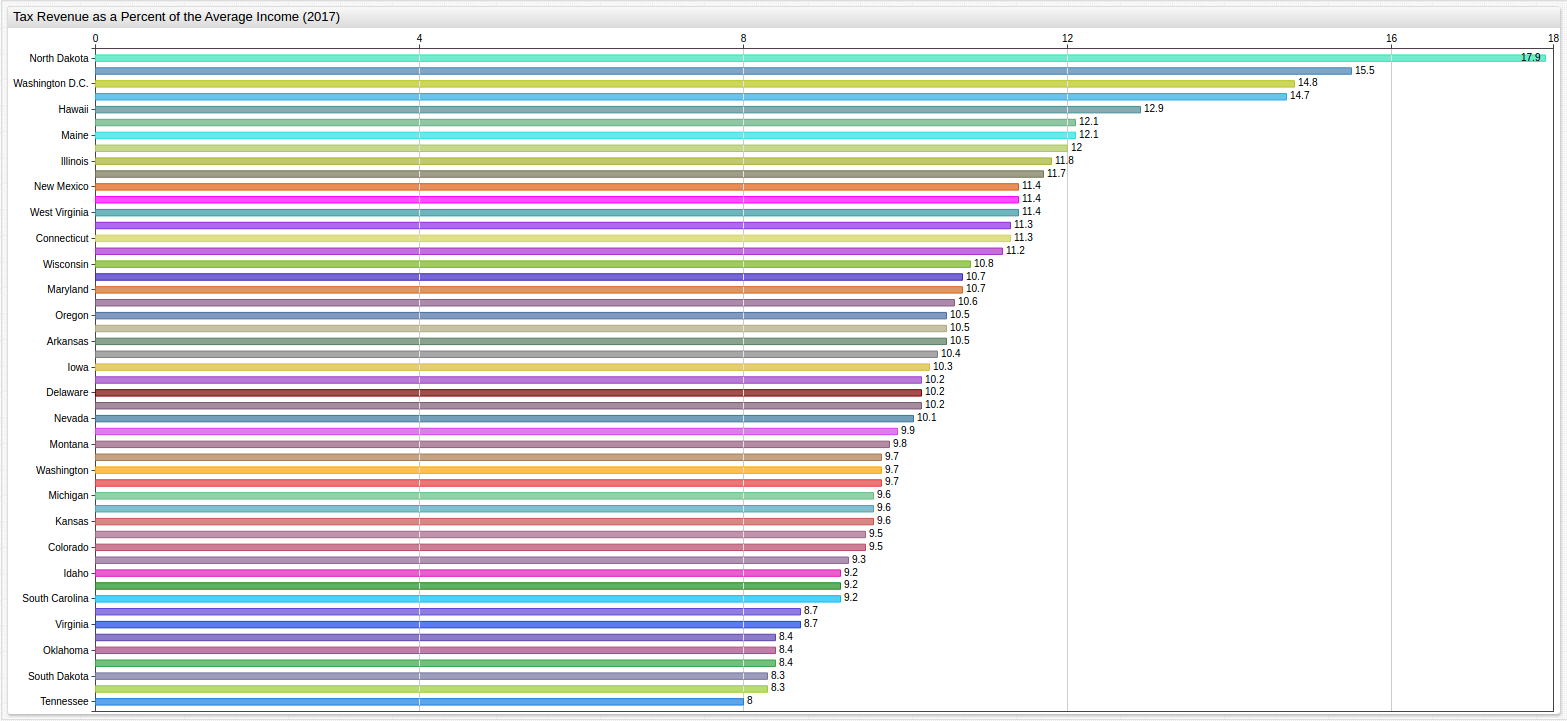

State and Local Tax Revenue Expressed as a Percent of the Average Income

This is the percent of their income the average filer in a given state can expect to pay out through state and local taxes.

SELECT tags.state AS "State", value AS "Total Tax Rate (%)"

FROM state_local_tax_revenue_perc_income

GROUP BY 'State', value

ORDER BY value desc

| State | Total Tax Rate (%) |

|---|---|

| North Dakota | 17.90 |

| New York | 15.50 |

| Washington D.C. | 14.80 |

| Alaska | 14.70 |

| Hawaii | 12.90 |

| Maine | 12.10 |

| Vermont | 12.10 |

| Minnesota | 12.00 |

| Illinois | 11.80 |

| New Jersey | 11.70 |

| California | 11.40 |

| New Mexico | 11.40 |

| West Virginia | 11.40 |

| Wyoming | 11.30 |

| Connecticut | 11.30 |

| Rhode Island | 11.20 |

| Wisconsin | 10.80 |

| Maryland | 10.70 |

| Nebraska | 10.70 |

| Massachusetts | 10.60 |

| Oregon | 10.50 |

| Arkansas | 10.50 |

| Mississippi | 10.50 |

| Ohio | 10.40 |

| Iowa | 10.30 |

| Delaware | 10.20 |

| Kentucky | 10.20 |

| Pennsylvania | 10.20 |

| Nevada | 10.10 |

| Utah | 9.90 |

| Montana | 9.80 |

| Washington | 9.70 |

| Louisiana | 9.70 |

| North Carolina | 9.70 |

| Indiana | 9.60 |

| Michigan | 9.60 |

| Kansas | 9.60 |

| Colorado | 9.50 |

| Texas | 9.50 |

| Arizona | 9.30 |

| Georgia | 9.20 |

| South Carolina | 9.20 |

| Idaho | 9.20 |

| Missouri | 8.70 |

| Virginia | 8.70 |

| Alabama | 8.40 |

| Oklahoma | 8.40 |

| New Hampshire | 8.40 |

| Florida | 8.30 |

| South Dakota | 8.30 |

| Tennessee | 8.00 |

Any of these tables or charts can be freely reproduced without the express permission of the author.

Contact Axibase with any questions.