Cryptocurrency Value Tracker

Overview

Although in existence since 2009, the world's first cryptocurrency Bitcoin did not begin making headlines until 2014 when the value of the digital asset grew almost 1,000% in just a few days, jumping from under $100 to almost $1,000. Then it happened again in 2017 at an even larger scale when Bitcoin was valued at nearly $20,000 a unit.

Things have cooled off slightly for BTC, as its known on the digital currency news and analysis site CoinDesk, but the sustained popularity of Bitcoin has led to the creation of hundreds of other similar products.

The relevance of the technology, and the acceptance of digital currency in general, is given a significant boost because the Federal Reserve announced that it now hosts cryptocurrency pricing data on its economic data website FRED. The pursuit of recognition and legitimacy has always been central to the ability of cryptocurrency to meaningfully sidestep traditional brick and mortar financial institutions, the inclusion of value data by the largest central bank in the world should come as welcome news.

Keywords

value, label, display, markers, format, import, fred.js, math.sin, currency

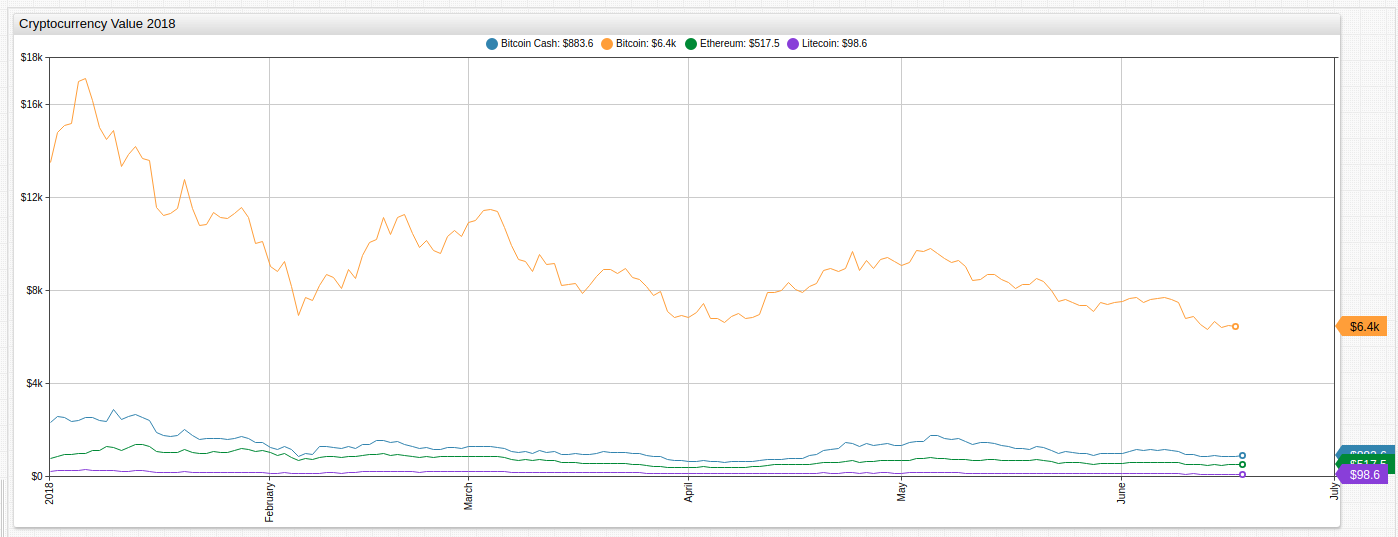

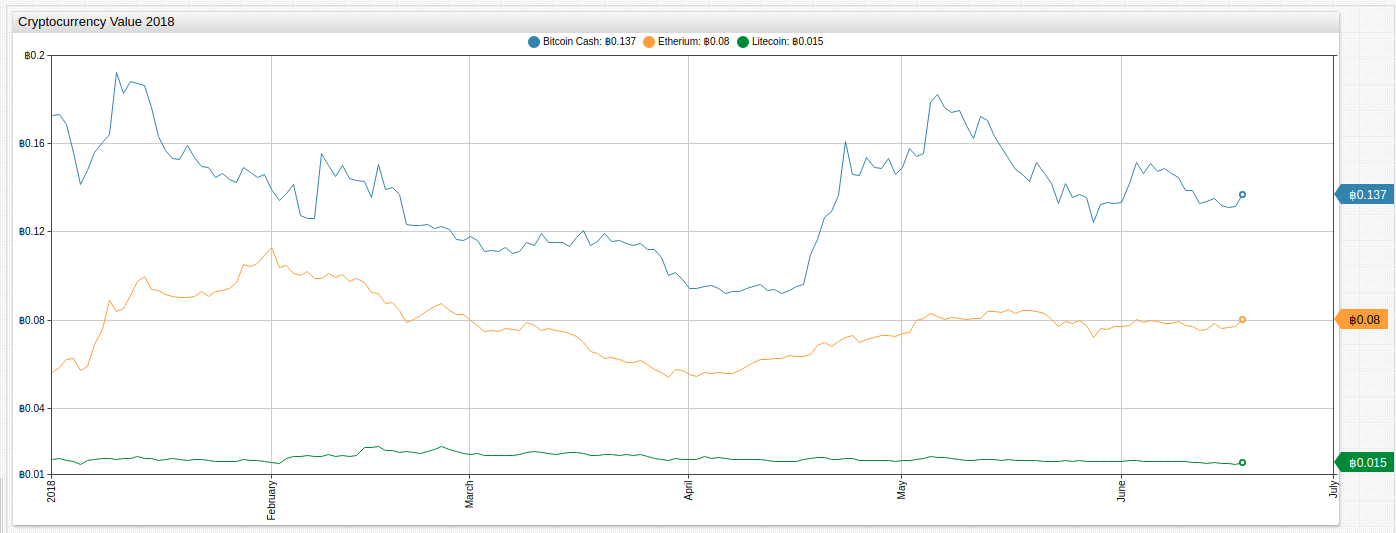

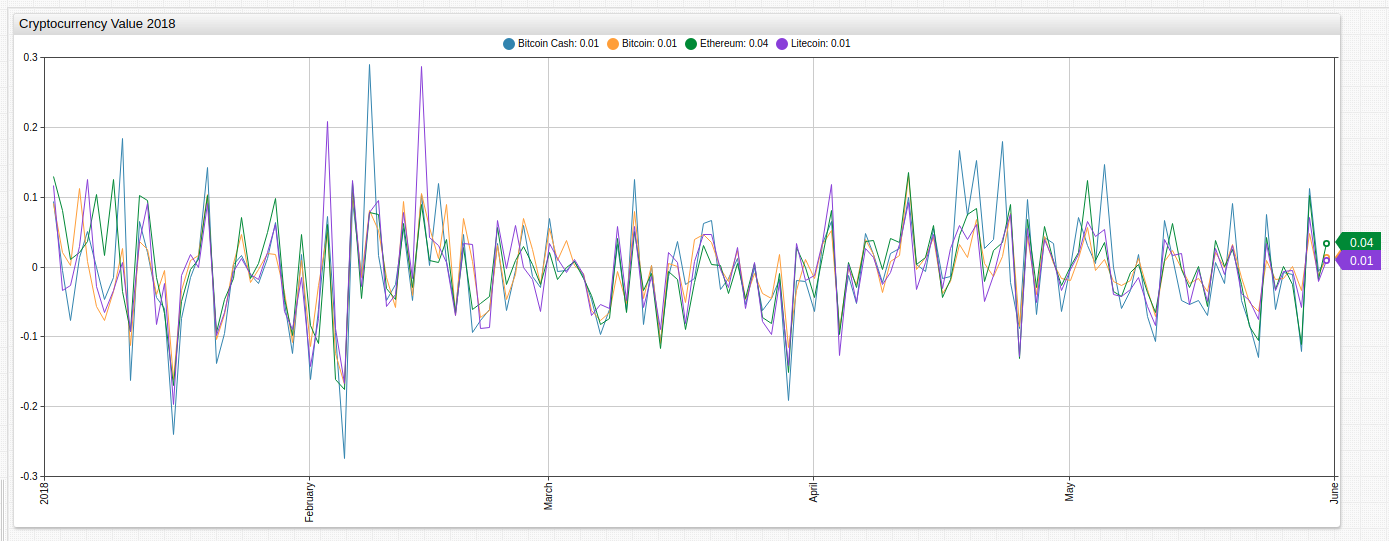

Bitcoin Index

Cryptocurrency movement against the dollar has always been volatile. This visualization tracks the value of Bitcoin against the other three cryptocurrencies showing that their relationship to one another is just as tenuous. Both Bitcoin Cash and Litecoin moved upwards or downwards more than 50% in relation to Bitcoin at least once in the 6-month observation period.

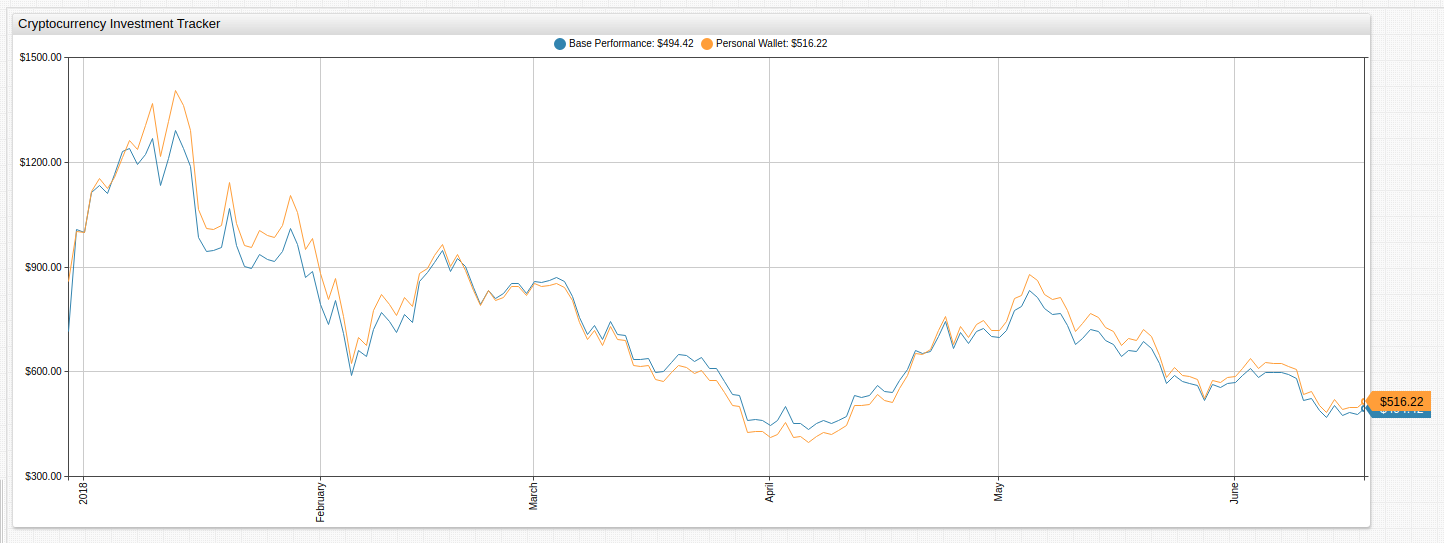

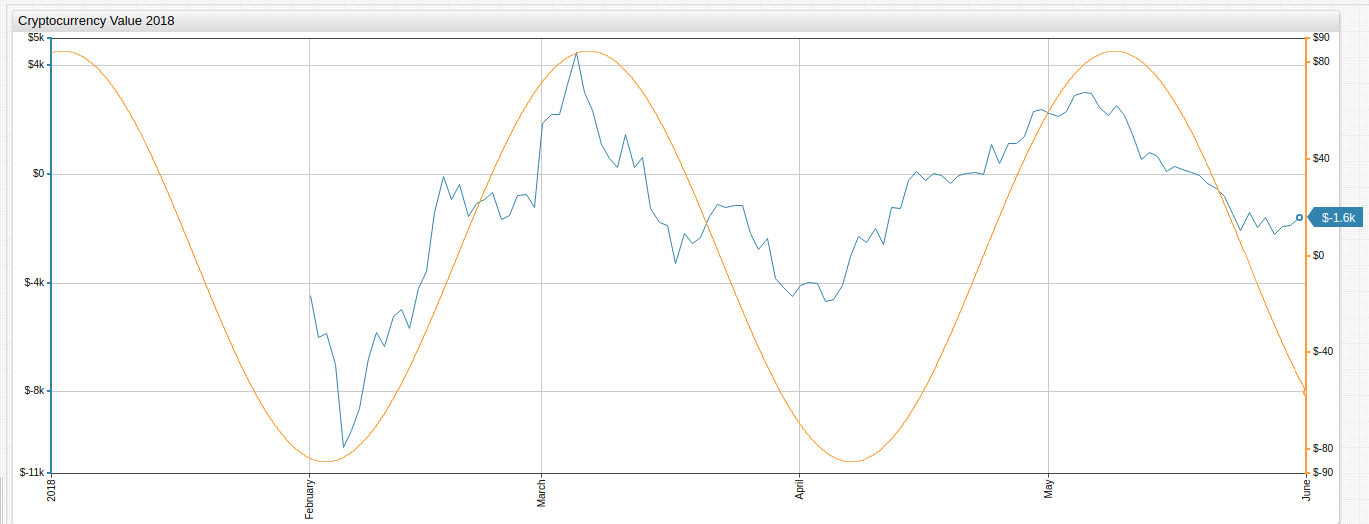

Example Investment

The chart below tracks two hypothetical investments. The Base Performance line tracks a investment of $1,000 spread evenly over each of the four cryptocurrencies purchased on January 1, 2018 and the Personal Wallet line tracks a second hypothetical investment of $1,000 spread unevenly among each of the four cryptocurrencies and made on a variable date.

Open the visualization and modify the var positions and value settings in the Editor window to see if you can create a profitable investment and outsmart the cryptocurrency market.

The default configuration tracks a custom investment of $100 Bitcoin, $400 Etherium, $100 Litecoin, and $400 Bitcoin Cash.

var positions = [['btc', 100], ['eth', 400], ['ltc', 100], ['bch', 400]]

Modify the value setting to customize the date of purchase. By default, the investment is purchased at 2018-01-01 prices.

value = +value('@{position[0]}')*@{position[1]}/fred.ValueForDate('@{position[0]}','2018-01-01')

The final value of the Base Performance investment is $494.42 against the Personal Wallet investment value of $516.22.

Mathematical Functions

The charts in this article track cryptocurrency prices for 2018 and transform the underlying data using user-defined functions in ATSD and ChartLab. The fred.js library is a collection of mathematical functions used to transform FRED data.

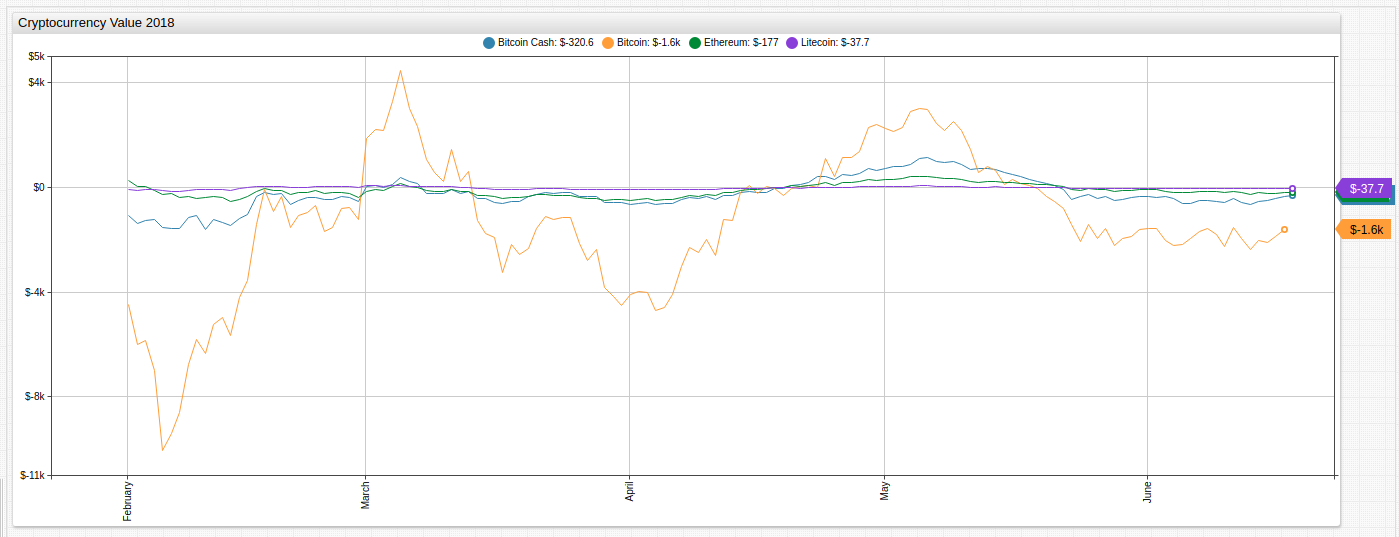

Monthly Change

Although Bitcoin had the largest absolute movement during the observed period, each currency behaved similarly.

Monthly Percent Change

Cryptocurrency markets fluctuate at surprisingly similar rates when comparing month-on-month percentile change.

Log Return

The log return value of a dataset is computed ln(value_t/value_t-1). By creating the argument using a consecutive value calculation and applying the natural logarithm function, log returns may be used to quickly estimate and compare asset performance using normalized data.

Log returns are helpful for comparing assets of different orders of value such as BTC (average value $7000) and LIC (average value $200). With minor deviations, all four cryptocurrencies had similar log return values.

Dow Theory

Comparing Bitcoin monthly value change to the sine function demonstrates the semi-regular periodicity of asset value hypothesized by Charles H. Dow over 100 years ago. As Dow's theory is meant to explain the cyclical nature of asset valuation caused by human factors, applying the principle to the intrinsically valueless cryptocurrency is an interesting study.

Different Prices, Similar Story

Comparing absolute returns, percent returns, and log returns shows that although each of the four selected cryptocurrencies are used by a variable number of consumers for a variable number of transactions, and valued on significantly different orders of magnitude, the patterns of returns are quite similar.

Although it may prove not to be economically viable as a means of currency, blockchain technology is already being implemented in a number of other industries to ensure data consistency and security.