Producers are Spending Less While Consumers are Paying More

Introduction

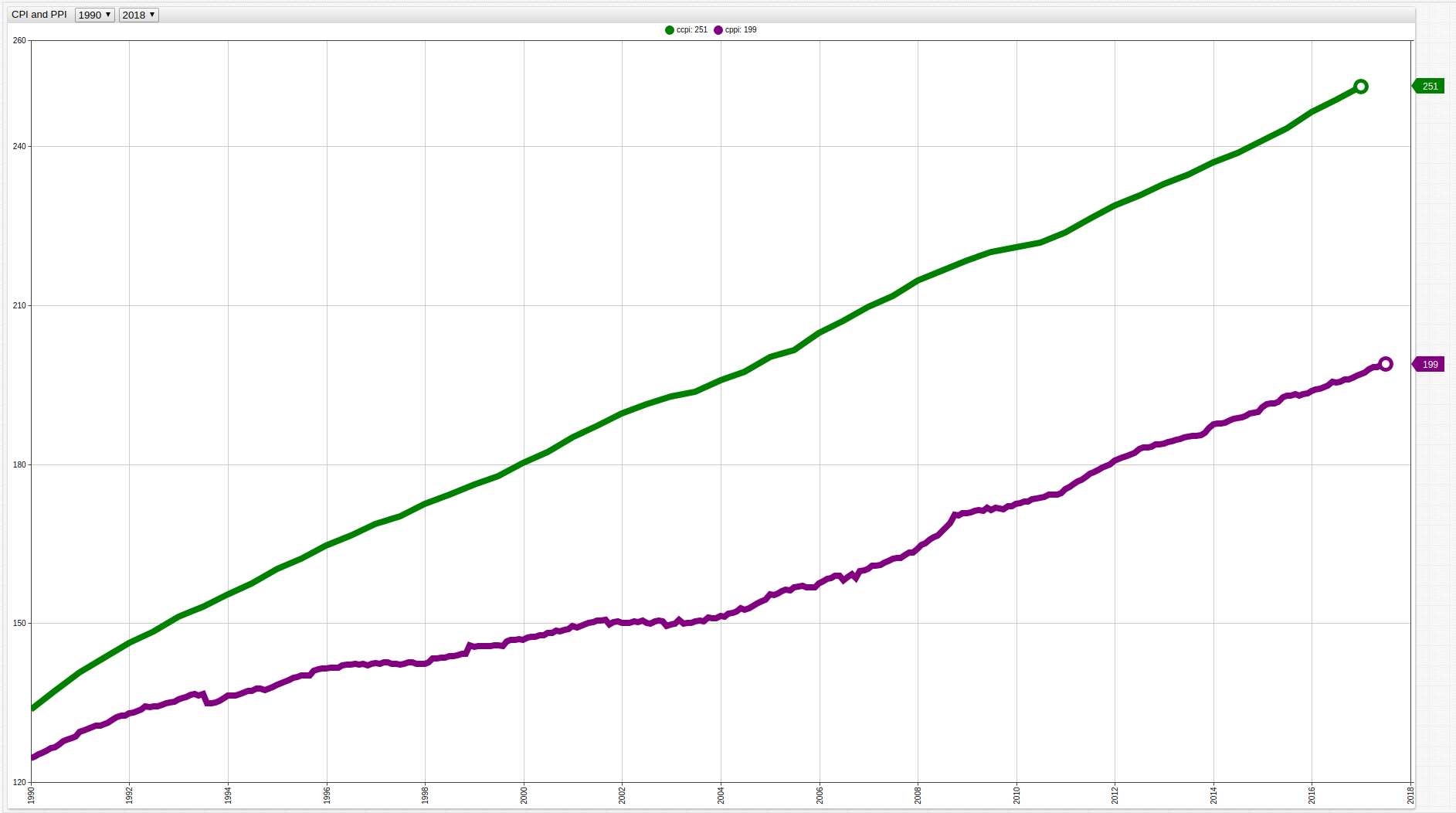

The Consumer Price Index (CPI) is the metric most commonly associated with inflation. It tracks the average cost of consumer goods, and tracks the changing prices that consumers are paying for a typical basket of such goods. To learn more about the effect of the CPI refer to The Consumer Price Index Versus Your Savings Account, which tracks how CPI affected the value of the Israeli Shekel over several decades.

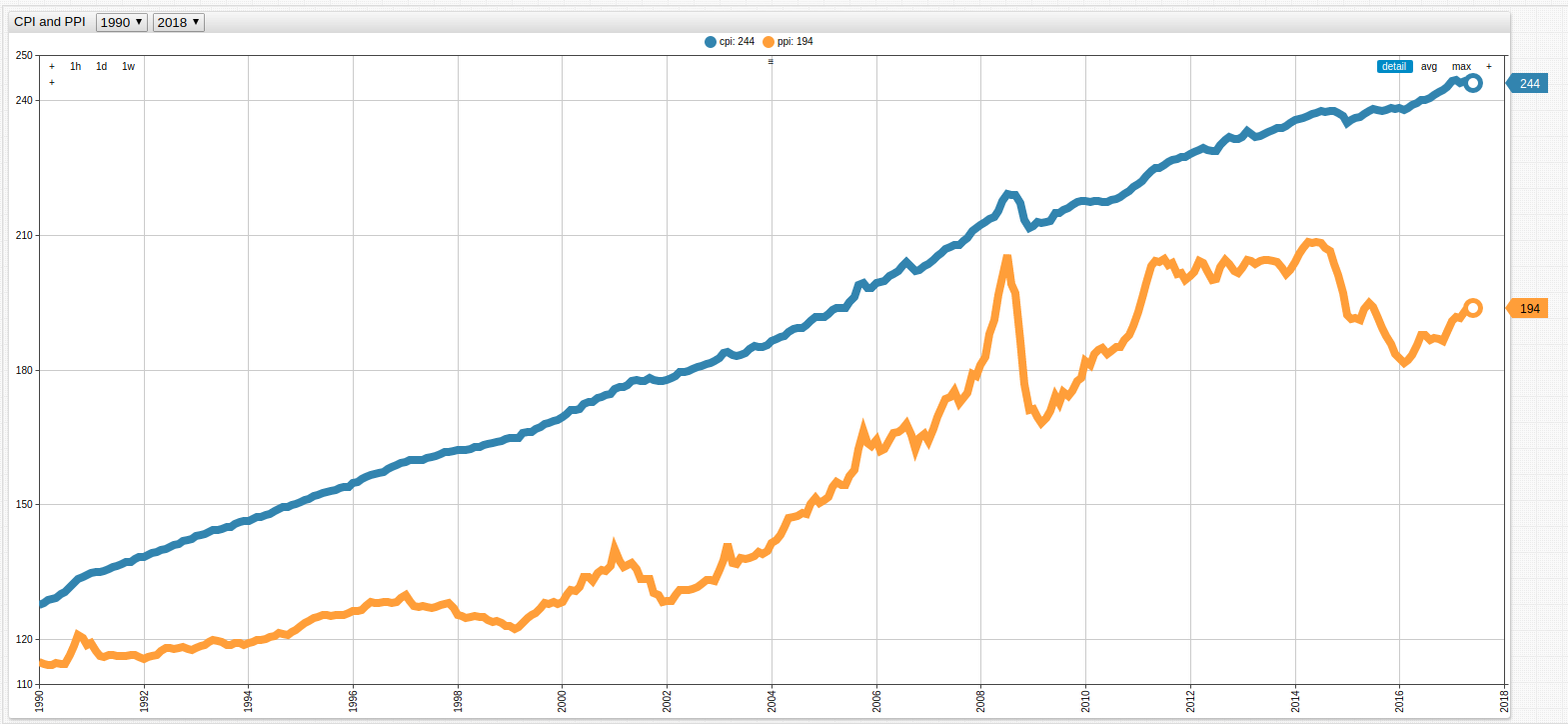

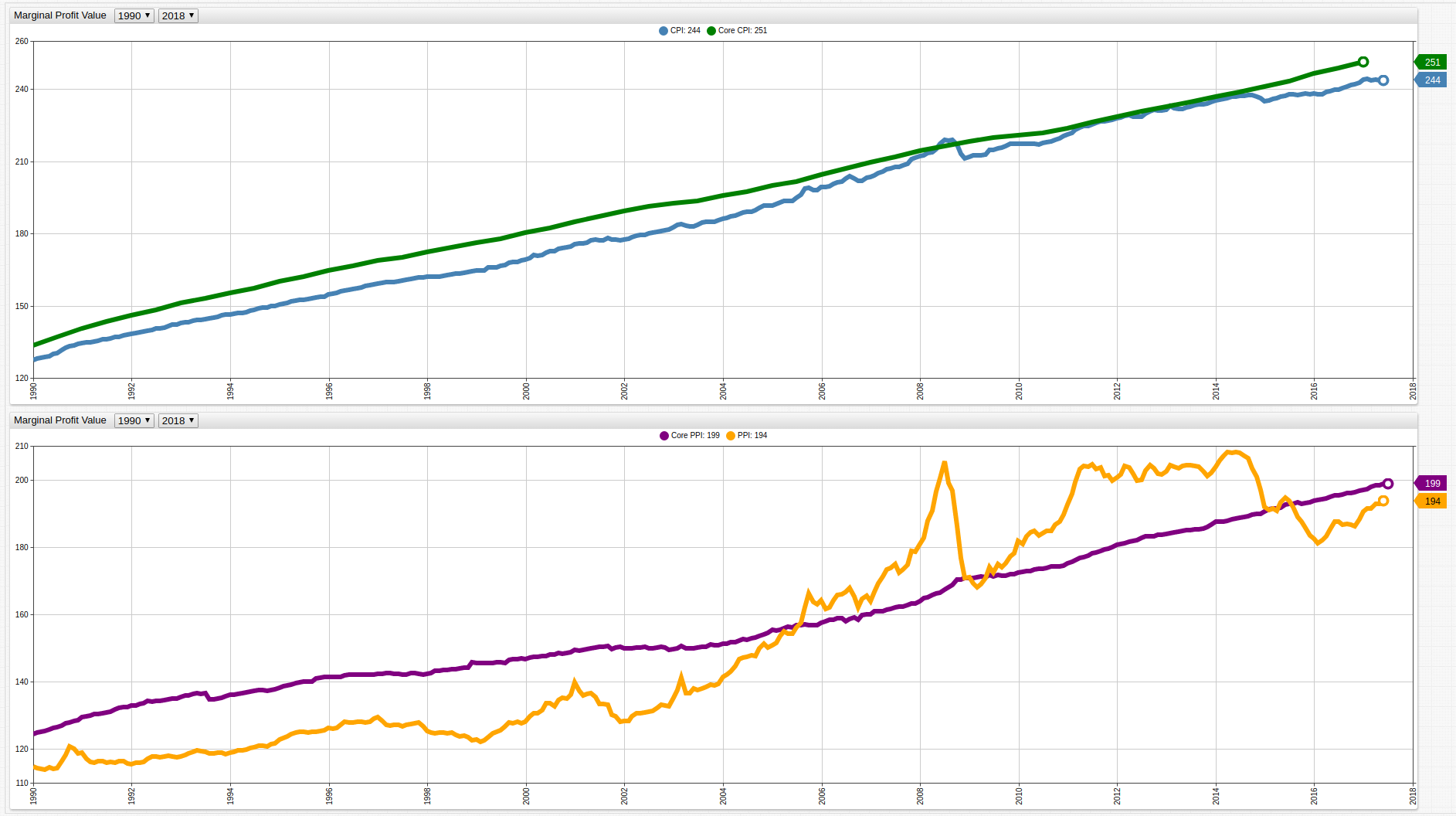

The Producer Price Index (PPI) is a complementary metric which tracks the amount of capital that producers are using to create a final product. Both are shown below from 1990 to 2017:

Figure 1: United States CPI (blue) and PPI (orange)

Open any ChartLab visualization to navigate through time using the drop-down lists at the top of the screen.

Sources: Federal Reserve Economic Data (CPI), Federal Reserve Economic Data (PPI)

Both of the above metrics are indexed from the year 1982, which is used as the baseline. This choice is somewhat arbitrary as such a decision simply sets the value of the index year to 100 and all other data points represent some proportion of that value. A value of 50 would indicate proportionally half of the 1982 value, while a value of 150 would indicate a value 1.5 times greater than the 1982 value. Because CPI and PPI have been converted to unitless values, they can be directly compared.

Recent Data

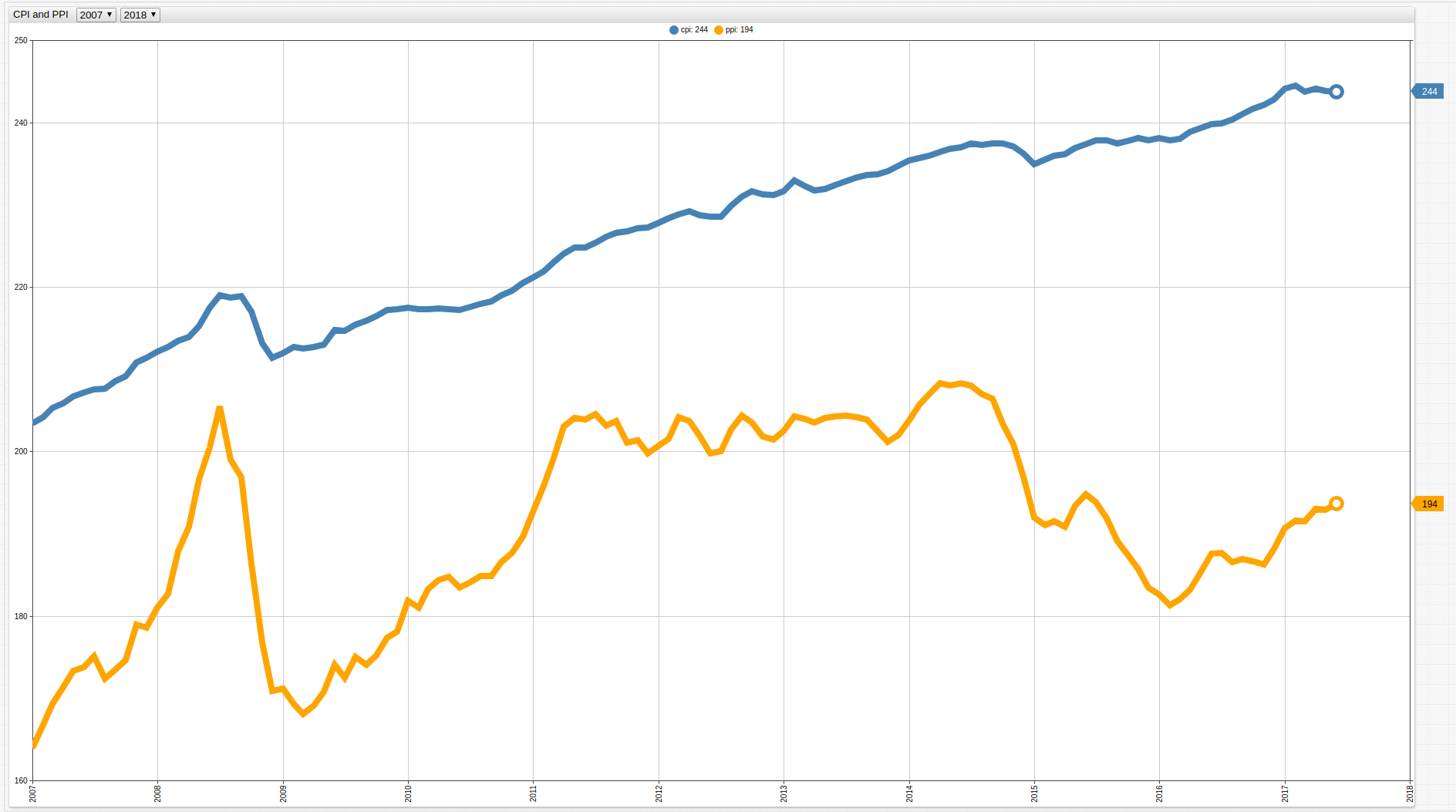

By modifying the observation period of the above data to begin in 2007, which is usually considered to be the first year of the Great Recession, substantial producer losses are shown by unequal changes in CPI and PPI values:

Figure 2: United States CPI and PPI (2007-Present)

Using SQL Console in ATSD, the underlying data can be explored to calculate producer losses during the worst year of the recession for American producers:

SELECT date_format(time, 'MM-yyyy') AS "Date", cpi.value AS "CPI", ppi.value AS "PPI", (cpi.value - ppi.value) AS "Potential Profitability Value"

FROM cpi AS cpi JOIN ppi AS ppi WHERE YEAR(time) = 2008

Marginal profit is the value retained by a producer after creating and selling one unit. Here it is represented as the value of the CPI less the value of the PPI.

Table 1: Marginal Profit Year 2008

| Date | CPI | PPI | Potential Profitability Value |

|---------|-------|-------|-----------------------|

| 01-2008 | 212.2 | 181.0 | 31.2 |

| 02-2008 | 212.7 | 182.7 | 30.0 |

| 03-2008 | 213.4 | 187.9 | 25.5 |

| 04-2008 | 213.9 | 190.9 | 23.0 |

| 05-2008 | 215.2 | 196.6 | 18.6 |

| 06-2008 | 217.5 | 200.5 | 17.0 |

| 07-2008 | 219.0 | 205.5 | 13.5 |

| 08-2008 | 218.7 | 199.0 | 19.7 |

| 09-2008 | 218.9 | 196.9 | 22.0 |

| 10-2008 | 217.0 | 186.4 | 30.6 |

| 11-2008 | 213.2 | 176.8 | 36.4 |

| 12-2008 | 211.4 | 170.9 | 40.5 |

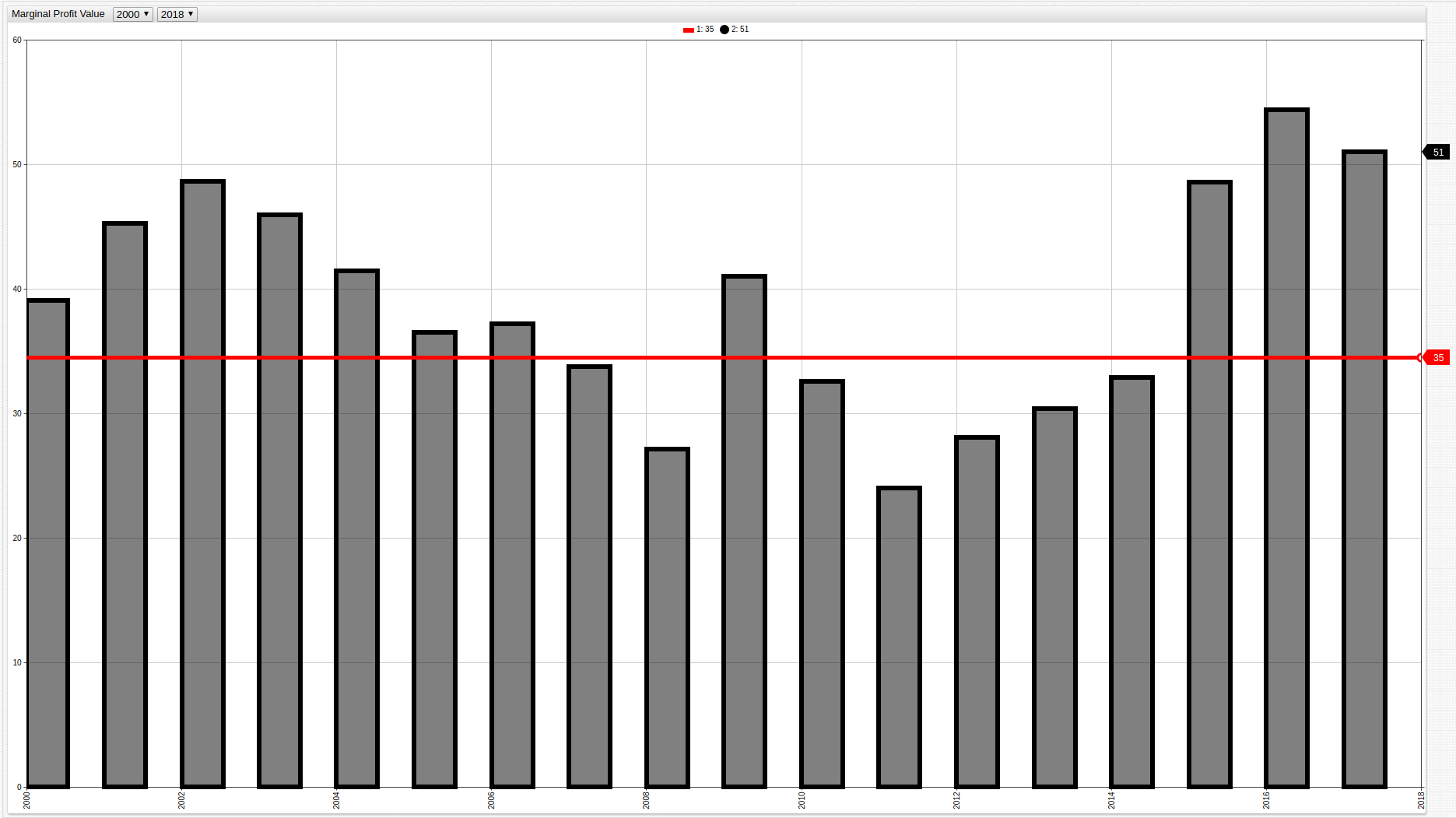

To effectively contextualize this data, average Potential Profitability Values are shown below by year:

SELECT YEAR(time) AS "Date", AVG(cpi.value) AS "Avg CPI", AVG(ppi.value) AS "Avg PPI", AVG(cpi.value - ppi.value) AS "Potential Profitability Value"

FROM cpi AS cpi JOIN ppi AS ppi

GROUP BY YEAR(time)

This query aggregates Potential Profitability Value by year for the entire observed period.

Table 2: Average Potential Profitability Value (1990-present)

| Date | Avg CPI | Avg PPI | Potential Profitability Value |

|------|---------|---------|-----------------------|

| 1990 | 130.7 | 116.3 | 14.4 |

| 1991 | 136.2 | 116.5 | 19.6 |

| 1992 | 140.3 | 117.2 | 23.1 |

| 1993 | 144.5 | 118.9 | 25.6 |

| 1994 | 148.2 | 120.4 | 27.8 |

| 1995 | 152.4 | 124.8 | 27.6 |

| 1996 | 156.9 | 127.7 | 29.2 |

| 1997 | 160.5 | 127.6 | 32.9 |

| 1998 | 163.0 | 124.4 | 38.6 |

| 1999 | 166.6 | 125.5 | 41.1 |

| 2000 | 172.2 | 132.7 | 39.4 |

| 2001 | 177.0 | 134.2 | 42.8 |

| 2002 | 179.9 | 131.1 | 48.8 |

| 2003 | 184.0 | 138.1 | 45.9 |

| 2004 | 188.9 | 146.7 | 42.2 |

| 2005 | 195.3 | 157.4 | 37.9 |

| 2006 | 201.6 | 164.8 | 36.8 |

| 2007 | 207.3 | 172.7 | 34.7 |

| 2008 | 215.3 | 189.6 | 25.7 |

| 2009 | 214.6 | 172.9 | 41.7 |

| 2010 | 218.1 | 184.7 | 33.3 |

| 2011 | 224.9 | 201.0 | 23.9 |

| 2012 | 229.6 | 202.2 | 27.4 |

| 2013 | 232.9 | 203.4 | 29.5 |

| 2014 | 236.7 | 205.3 | 31.4 |

| 2015 | 237.0 | 190.4 | 46.5 |

| 2016 | 240.0 | 185.4 | 54.6 |

| 2017 | 244.0 | 192.2 | 51.8 |

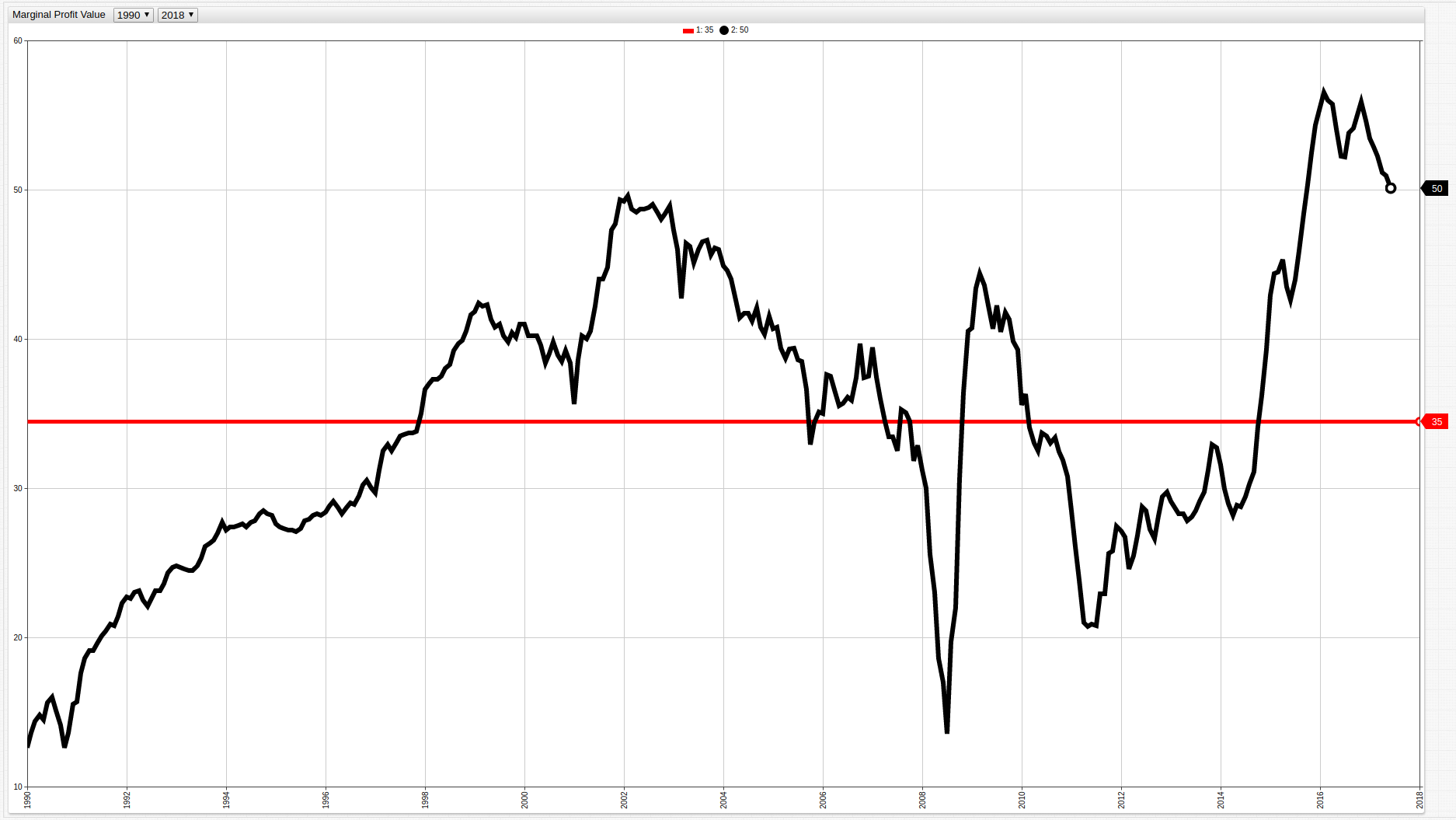

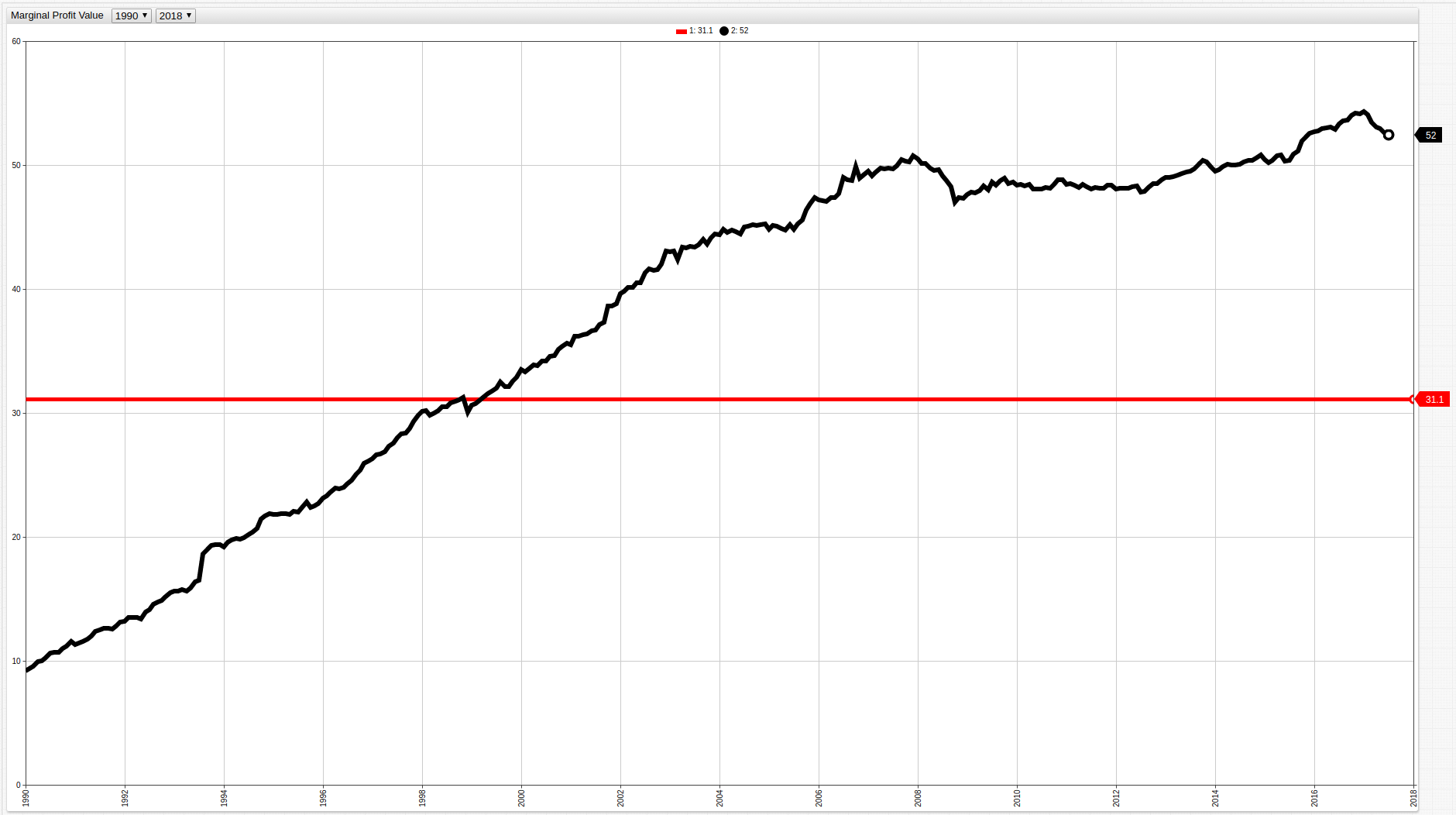

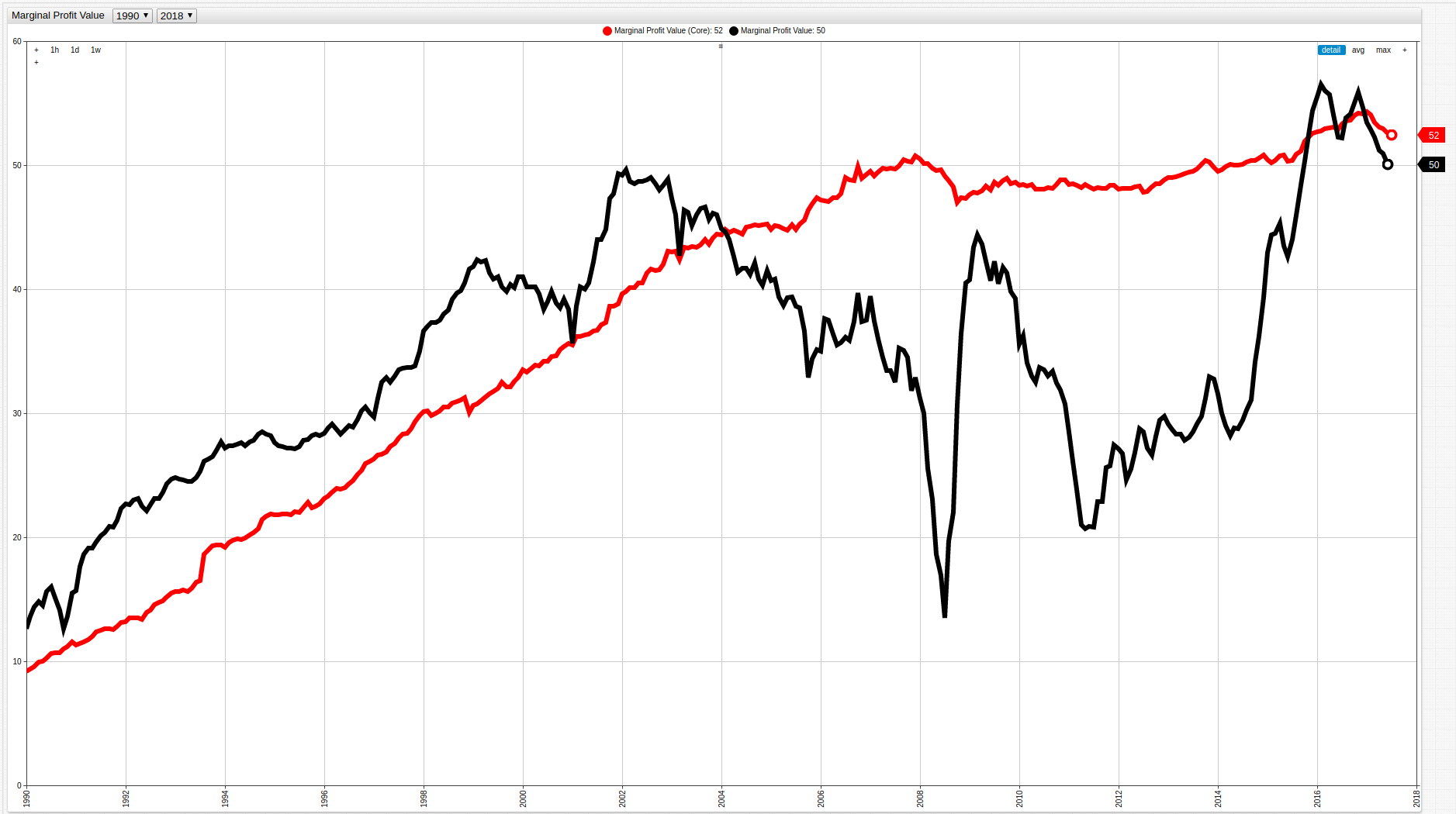

As shown in the table above and figure below, the Potential Profitability Value has been steadily growing since 1990 with number of notable exceptions.

Figure 3: Potential Profitability Value (1990-present)

The red line shows the average Potential Profitability Value over the entire observed period.

SELECT AVG(cpi.value) AS "Avg CPI", AVG(ppi.value) AS "Avg PPI", AVG(cpi.value - ppi.value) AS "Potential Profitability Value"

FROM cpi AS cpi JOIN ppi AS ppi

Table 3: Average CPI, PPI, and MPV (1990-present)

| Avg CPI | Avg PPI | Potential Profitability Value |

|---------|---------|-----------------------|

| 188.2 | 153.7 | 34.5 |

Using the movavg() moving average function to aggregate the

average values in annual increments instead of across the entire observed period smooths the MPV curve and shows the effects

of the recession on producer profits.

Refer to Curve Smoothing Using Weighted Averages for more information about using moving and weighted averages.

Figure 4: MPV Annual Aggregation

Analysis

A consistently growing Potential Profitability Value, calculated as a growing difference in CPI and PPI values, indicates that producers are spending less money producing goods but consumers are continuing to pay more. In recent years, the sharp increase in MPV seen from 2015 to present is most likely explained by corporate desire to increase profits after significant losses during the recession. Keep in mind that in this case significant losses mean significant relative losses in overall profit, and not actual negative growth in most cases. In fact, the Potential Profitability Value only exceeded 30 points for the first time in 1996, with the next year a sub-thirty point value appeared being more than a decade later in 2008. This comparison makes no statement about overall profits generated by a certain collection of industries, but rather observes the average marginal profit that producers are generating from products that they do sell. The recession not only caused a contraction of gross profit and the number of products sold, but also reduced the amount of profit generated on items that did manage to be sold.

Because CPI and PPI values used in the above visualization include all spheres of production and consumption, occasionally volatile industries such as energy and food are included as well, potentially skewing the output. There is a second version of these metrics called core CPI and core PPI, which removes this volatility by excluding energy and food production and consumption. The calculations shown above can be repeated with core CPI and PPI to account for this fluctuation.

Figure 5: Core CPI and Core PPI

Immediately visible is the lack of fluctuation in both CPI and PPI surrounding the years of the recession. The underlying data is shown below from 1990 to present:

SELECT YEAR(time) AS "Date", AVG(ccpi.value) AS "Avg cCPI", AVG(cppi.value) AS "Avg cPPI", AVG(ccpi.value - cppi.value) AS "Potential Profitability Value"

FROM ccpi AS ccpi JOIN cppi AS cppi

GROUP BY YEAR(time)

Table 4: Average cCPI, cPPI, and PPV

| Date | Avg cCPI | Avg cPPI | Potential Profitability Value |

|------|----------|----------|-----------------------|

| 1990 | 135.4 | 125.5 | 9.9 |

| 1991 | 142.2 | 130.2 | 11.9 |

| 1992 | 147.3 | 133.7 | 13.6 |

| 1993 | 152.1 | 136.1 | 16.0 |

| 1994 | 156.5 | 136.8 | 19.7 |

| 1995 | 161.2 | 139.3 | 21.9 |

| 1996 | 165.6 | 141.8 | 23.7 |

| 1997 | 169.5 | 142.3 | 27.2 |

| 1998 | 173.4 | 143.1 | 30.3 |

| 1999 | 177.0 | 145.7 | 31.3 |

| 2000 | 181.3 | 147.4 | 33.9 |

| 2001 | 186.1 | 150.0 | 36.1 |

| 2002 | 190.4 | 150.0 | 40.5 |

| 2003 | 193.2 | 150.1 | 43.2 |

| 2004 | 196.7 | 151.9 | 44.7 |

| 2005 | 200.9 | 156.1 | 44.8 |

| 2006 | 205.9 | 157.8 | 48.1 |

| 2007 | 210.7 | 161.1 | 49.6 |

| 2008 | 215.6 | 165.8 | 49.8 |

| 2009 | 219.2 | 171.1 | 48.1 |

| 2010 | 221.3 | 173.1 | 48.2 |

| 2011 | 225.0 | 176.8 | 48.3 |

| 2012 | 229.8 | 181.8 | 48.0 |

| 2013 | 233.8 | 184.6 | 49.3 |

| 2014 | 237.9 | 188.1 | 49.8 |

| 2015 | 242.2 | 191.8 | 50.4 |

| 2016 | 247.6 | 194.6 | 53.0 |

| 2017 | 251.3 | 197.0 | 54.3 |

Figure 6: Potential Profitability Value Using cCPI and cPPI (1990-present)

Open any ChartLab visualization to navigate through time using the drop-down lists at the top of the screen.

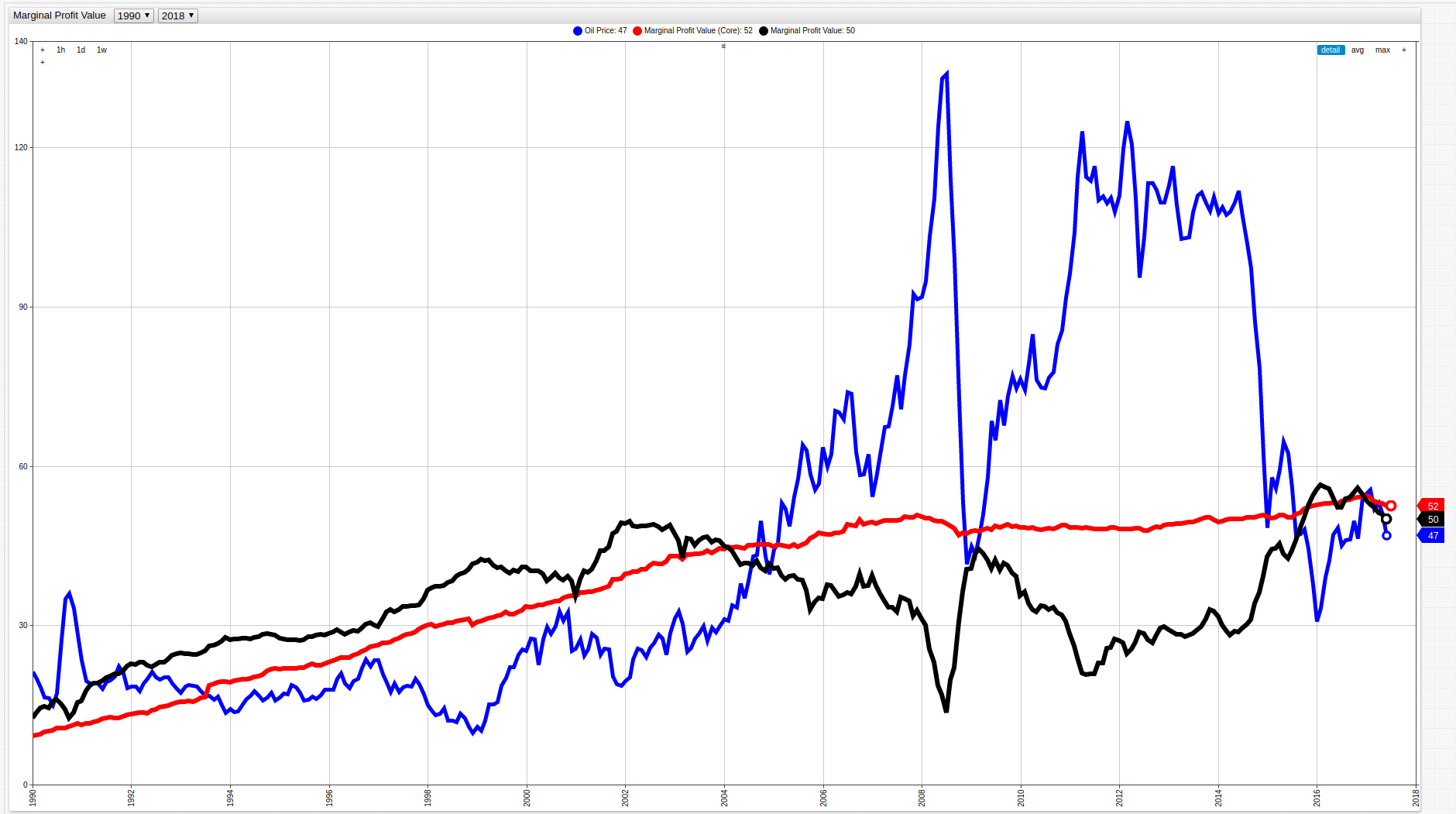

When data is controlled to exclude volatile metrics such as energy and food production and consumption, a more accurate representation of the difference between production costs and consumer costs is seen. To lend further credence to the instability of the energy market, the per barrel price of oil, one of the largest parts of the energy sector is shown below alongside the calculated both Potential Profitability Values calculated above:

Figure 7: Per Barrel Price of Crude Oil versus Potential Profitability Value

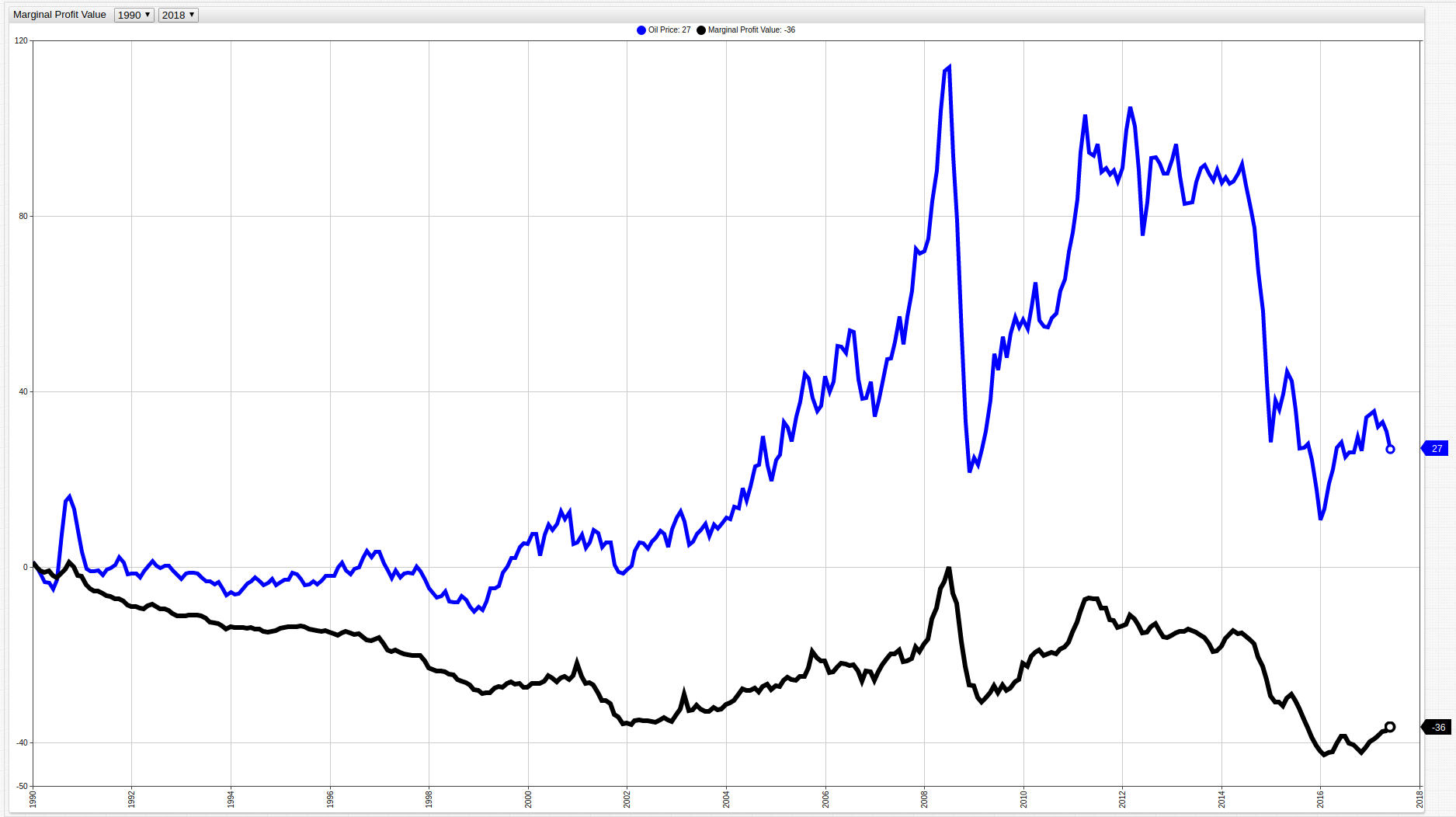

In fact, when the energy food sectors are not excluded from CPI and PPI values and compared with the per barrel price of crude oil they are shown to be intimately tied to one another. Inverting the axes of the black line representing Potential Profitability Value highlights this relationship further:

Figure 8: Per Barrel Price of Crude Oil versus Potential Profitability Value

Using an ad hoc modification to align the origin of the two metrics shows the growing gap between oil prices and marginal profit indicating that while some correlation exists, high oil prices do not guarantee a high marginal profit. In fact, because of the reflection across the x-axis, as oil prices increase, the value of marginal profit decreases.

Conclusion

Figure 9: Core Potential Profitability Value and Potential Profitability Value

Despite a significant decrease in marginal profit levels during the late 2000s, when including the energy sector and food sectors, it appears that businesses have mostly picked up where they left off since before the downturn. Indeed, when these industries are excluded an overall slowdown is still observed, but even the worst year of the recession shows a significantly smaller, and even delayed, effect indicating the true power of the oil market over the American economy.

Figure 10: Core CPI and CPI (Top), Core PPI and PPI (Bottom)

Ultimately, the overall cost of various consumer goods in a given basket is heavily impacted by the cost of oil because of the need to transport a given good to the needed location and with the nature of the globalized goods market, often that means a great deal of traveling required before a product reaches its consumer base.

Regardless of this condition, there is definitive growth between the difference in CPI and PPI, whether or not the volatile energy or food sectors are considered, indicating the growing gap between the amount that customers are paying to purchase something and the amount that producers are paying to create it.