U.S. Approaching 3-Year Mark for Full Employment

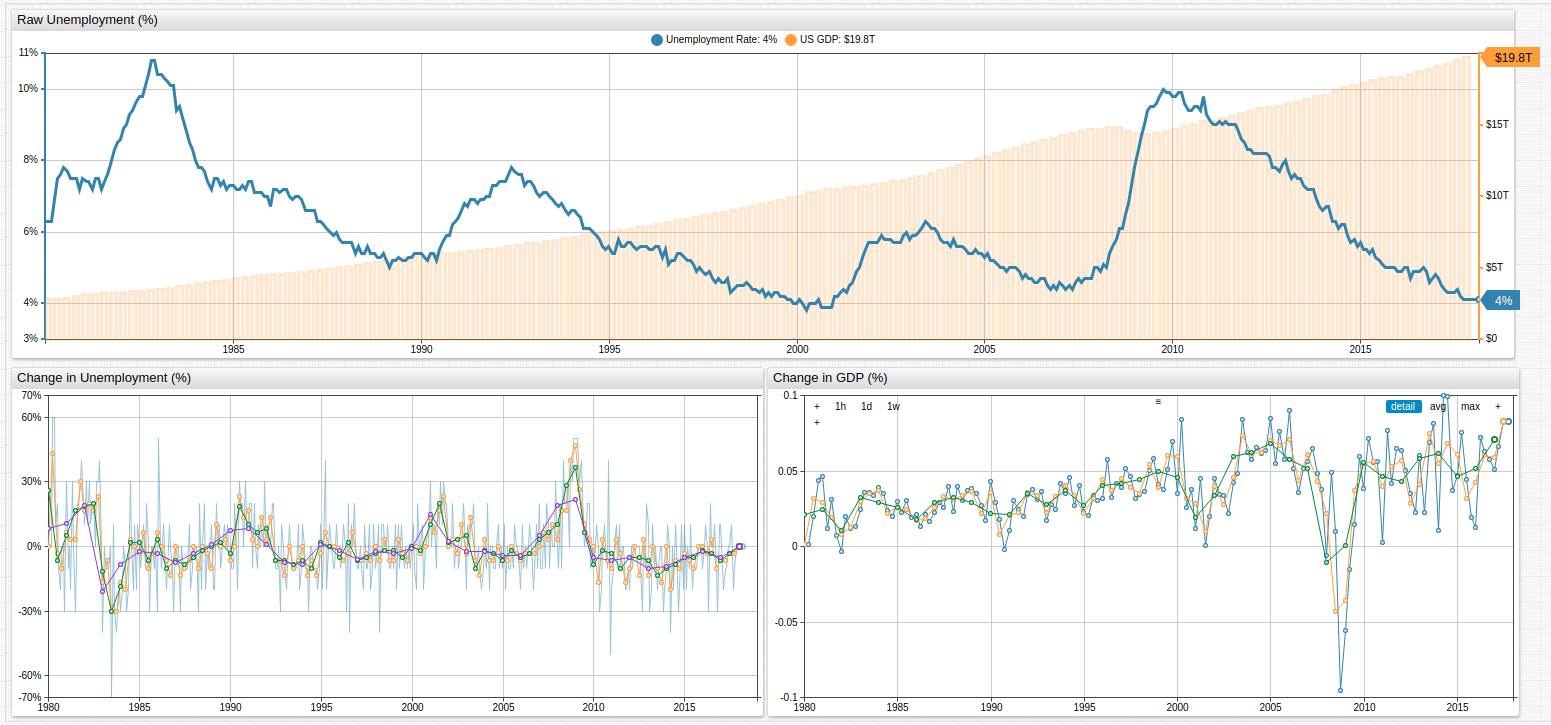

Fig 1. The upper chart in the Trends visualization above tracks U.S. unemployment and GDP, while the lower charts track percent change in unemployment and GDP value, respectively.

For specific configuration information about any of the visualizations in this article, see the Configuration section towards the end of this page.

Overview

Since the 1980s, the United States has almost always been on the wrong side of the unemployment statistics, only seeing full employment in the country for a handful of years leading up to September 11, 2001 and a few years again preceding the 2008-2009 stock market crash. The idealists among those in the economic class like to consider "Full Employment" to be somewhere around 1-2%, but the reality is that this is almost never the case. A phenomenon known as frictional unemployment means that most experts tend to consider a country fully-employed as long as the unemployment level is less than roughly 5%.

Frictional Unemployment

Frictional unemployment is the understanding that at any given time, some percentage of the population is unemployed of their own volition. Whether it is because of a personal sabbatical, the desire to find a new job without working during the hunt, or other circumstantial factors, some part of the population is counted as unemployed when perhaps they should not be.

Full Employment in the United States

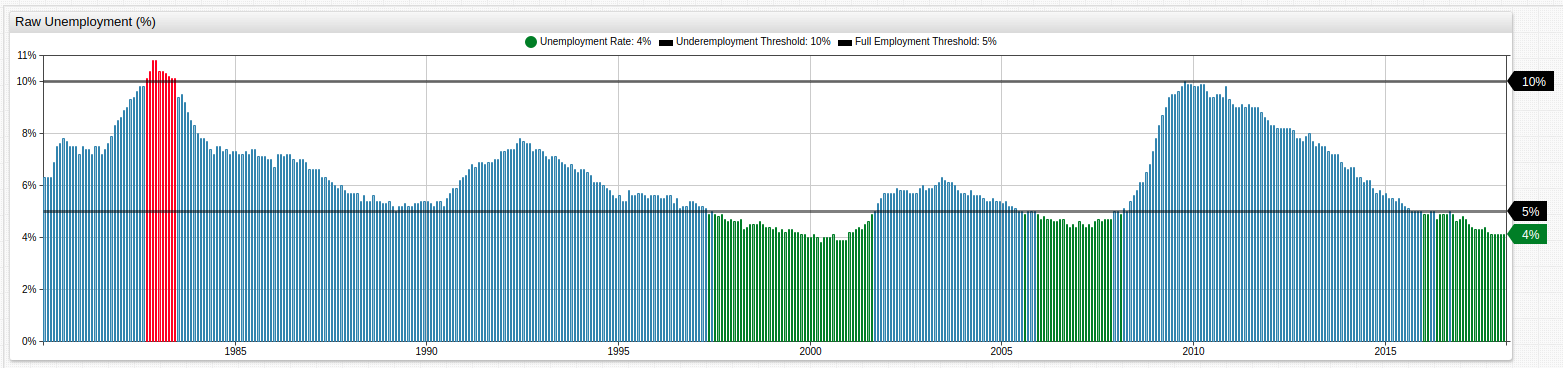

Fig 2. Periods of full employment are highlighted in green and periods of over 10% unemployment are highlighted in red. Full-employment and 10%-unemployment [threshold] series are used to highlight upper and lower value limits.

The Trends chart above tracks periods with full employment using an alert-expression. The exceptionally high unemployment period during the early 1980s may be explained by the then-ongoing worldwide recession which began in 1979 amid a global energy crisis caused by the Iranian oil embargo and subsequent Iran-Iraq war, combined with extreme Fed monetary policy meant to combat double-digit inflation. Ironically, the global oil supply only contracted about 4% during the embargo, but speculation, panic, and commodity runs caused a huge price surge which would not be reversed for almost twenty years.

The Relationship Between GDP and Unemployment

While correlation alone can never be used to prove causation, common sense tells us that the more unemployed there are in the population, the worse off the GDP inevitably is. Compare the percent-change charts from above for unemployment and GDP when they are overlaid on one another.

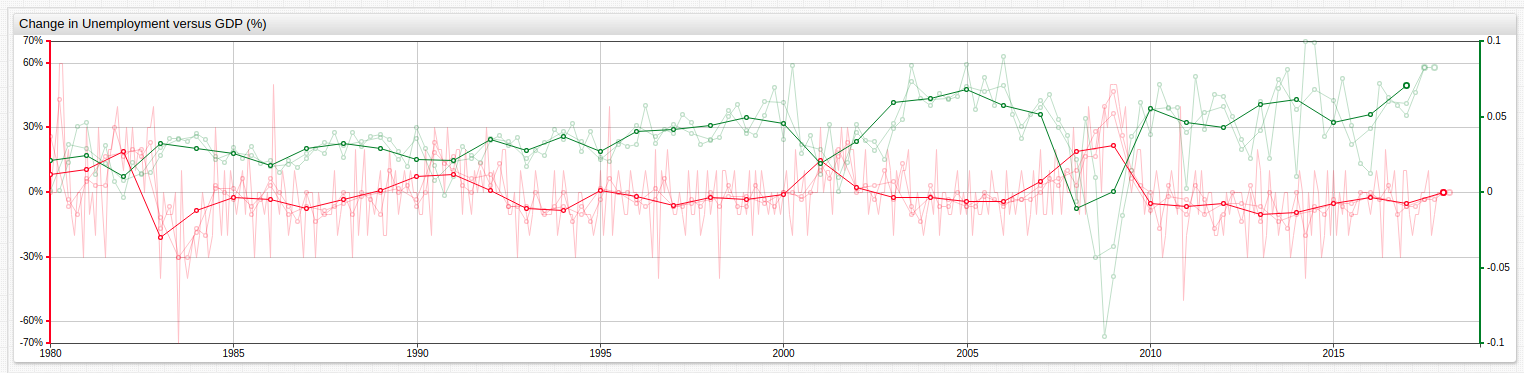

Fig 3. Series of dramatically different orders of magnitude may be shown on the same visualization using an axis setting.

Annual average percent change in both GDP and unemployment is the dominant line in the above visualization. Using the two-argument avg() function, a series may be averaged according to a user-specified time period. Because unemployment data is collected monthly, it has been averaged by month, quarter, half year, and year. Because GDP data is collected quarterly, it has been average by quarter, half year, and year.

Configuration

Read this brief guide about working in the Trends sandbox if you are unfamiliar with this service.

Fig 1. (for full configuration settings open the Trends visualization above)

## [configuration] level settings have been removed for brevity.

[series]

label-format = Unemployment Rate

format = %

replace-value = value/100

style = stroke-width:3

formatsetting is used to display numerical information without insignificant figures.

[series]

value = fred.MonthlyChange('base')

alias = month

display = false

valuesetting can define series value withoutentityormetric. In this case, a user-defined function is used for inline value calculation.

[series]

value = avg('month')

format = %

style = opacity: 0.5

[series]

value = avg('month', '.25 year')

format = %

avg()statistical function is used with one or two arguments representing thealiasof series to be averaged and theperiodacross which the average is calculated, respectively.For full configuration settings open the Trends visualization above)

## [configuration] level settings have been removed for brevity.

[series]

label-format = Unemployment Rate

replace-value = value/100

format = %

alert-expression = value

alert-style = if (alert > 0.10) return 'color: red'

alert-style = if (alert < 0.05) return 'color: green'

alert-expressionmay be created and customized usingalert-stylesetting, where

[threshold]

value = 0.10

color = black

format = %

style = stroke-width: 3; opacity: 0.5

label-format = Underemployment Threshold

[threshold]

value = 0.05

color = black

format = %

style = stroke-width: 3; opacity: 0.5

label-format = Full Employment Threshold

[threshold]settings are used to define upper and lower limits for particular values.For full configuration settings open the Trends visualization above.

[series]

color = green

axis = right

value = avg('m-gdp', '.25 year')

style = opacity: 0.25

axissetting is used to enable dual-axis functionality when comparing two series of different orders of magnitude.

Resources

The Trends service relies on ATSD for data-storage and processing tasks. All of the data from this article is stored in the publicly accessible instance of the Trends sandbox. Open any of the above visualizations shown here to perform custom modifications based on the Charts Documentation or any of the configuration settings explained in this article.

To create your own chart using the existing data, open an empty Trends instance.

Source data used for this article is linked here:

U.S. Bureau of Labor Statistics, Civilian Unemployment Rate

U.S. Bureau of Economic Analysis, Gross Domestic Product